PayPal • Product expansion

Reimagining PayPal Checkout

Overview

As Principal Product Designer, I led a redesign of PayPal’s checkout architecture to address rising competition and evolving user expectations. We focused on improving transparency and feature discoverability, especially for options like “Pay in 4” and Split payments, while maintaining an 80% conversion rate.

My role

As the lead designer for checkout, I provided leadership and direction across the entire design process for 3 designers, guiding design strategy, team collaboration, and execution, while combining hands-on work conceptualizing main screens and card interactions.

Impact

The redesigned PayPal checkout successfully met key objectives and delivered significant value while improving the user experience, enabling business growth and strengthening PayPal's competitive stance:

Credit adoption increase

Credit adoption increase

Credit adoption increase

Credit applications coming from checkout increased from 2% to 6%

Steadily high conversion

Steadily high conversion

Steadily high conversion

Successfully preserved our critical 80% checkout transaction rate

Improved satisfaction

Customer feedback indicated high satisfaction after the redesign.

Challenge

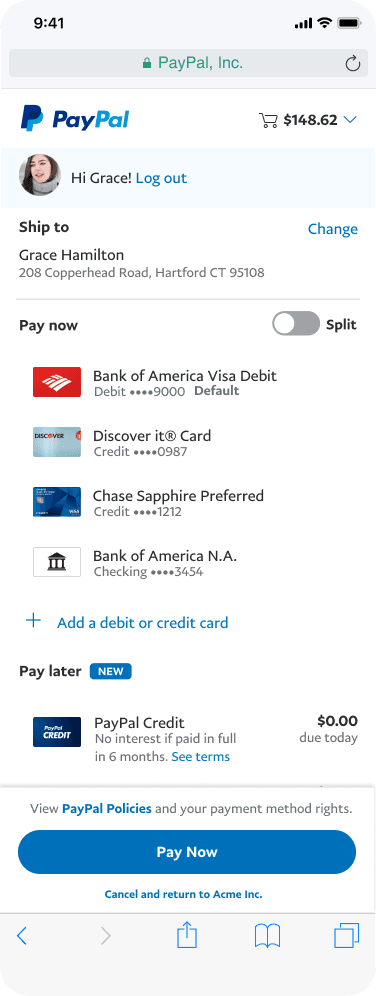

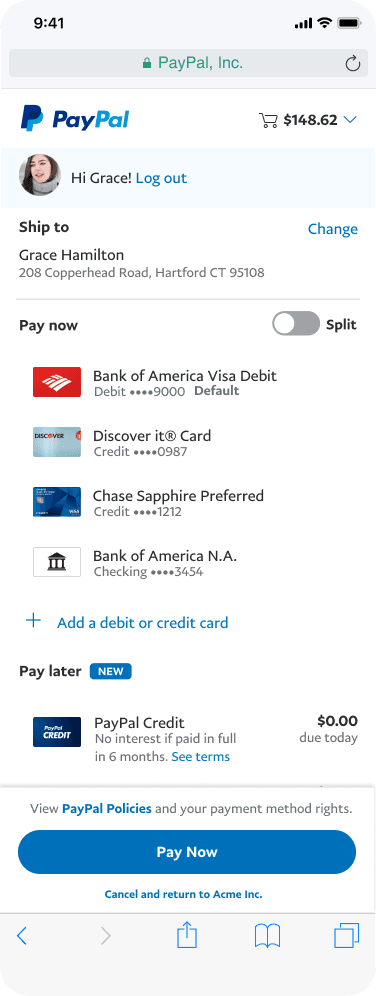

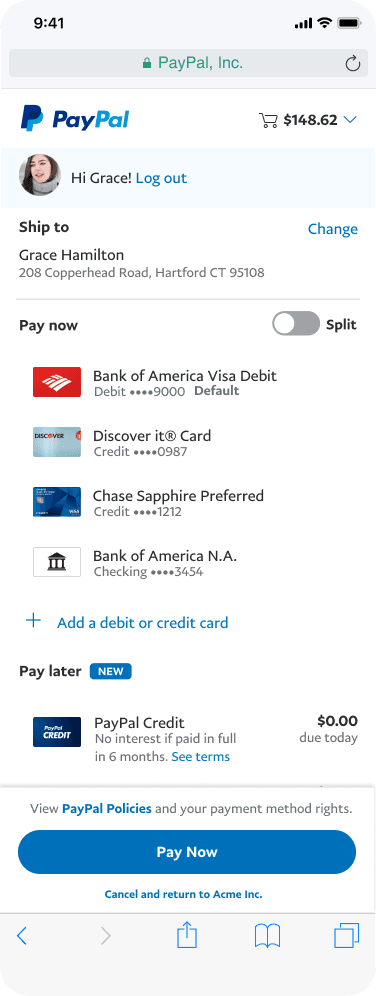

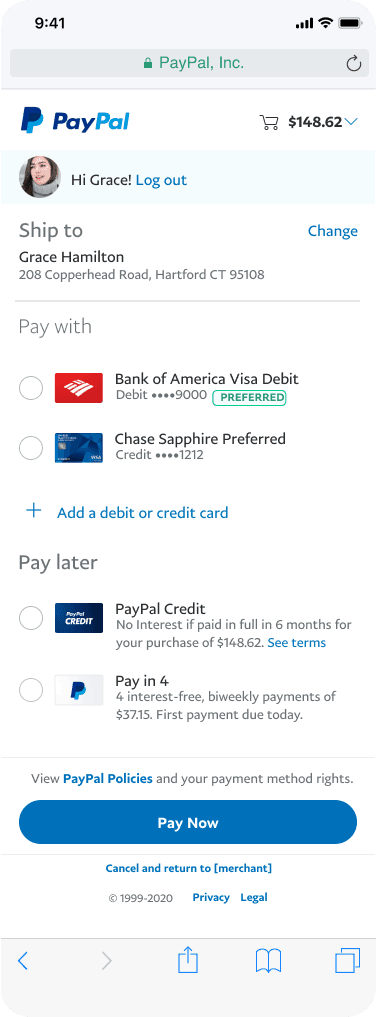

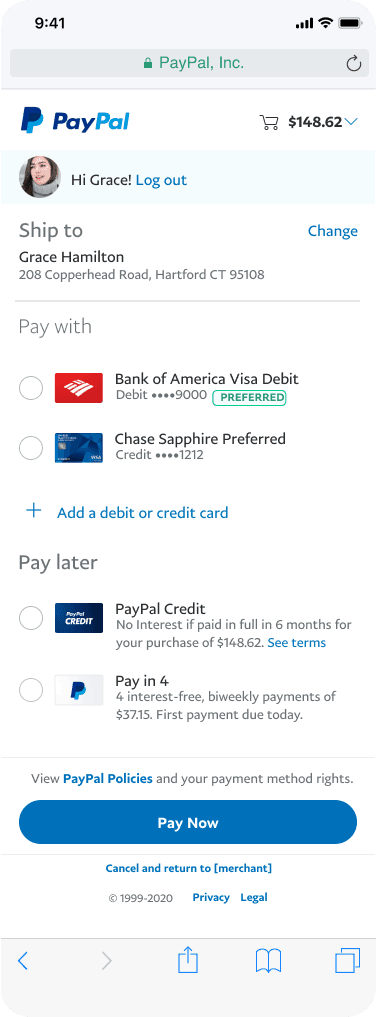

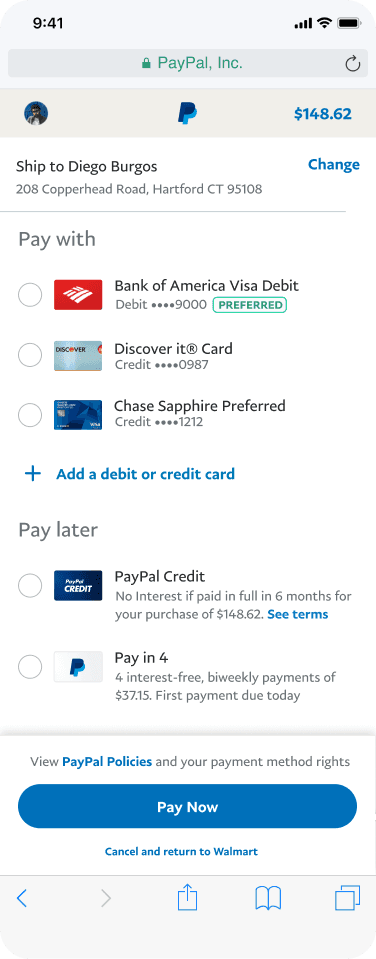

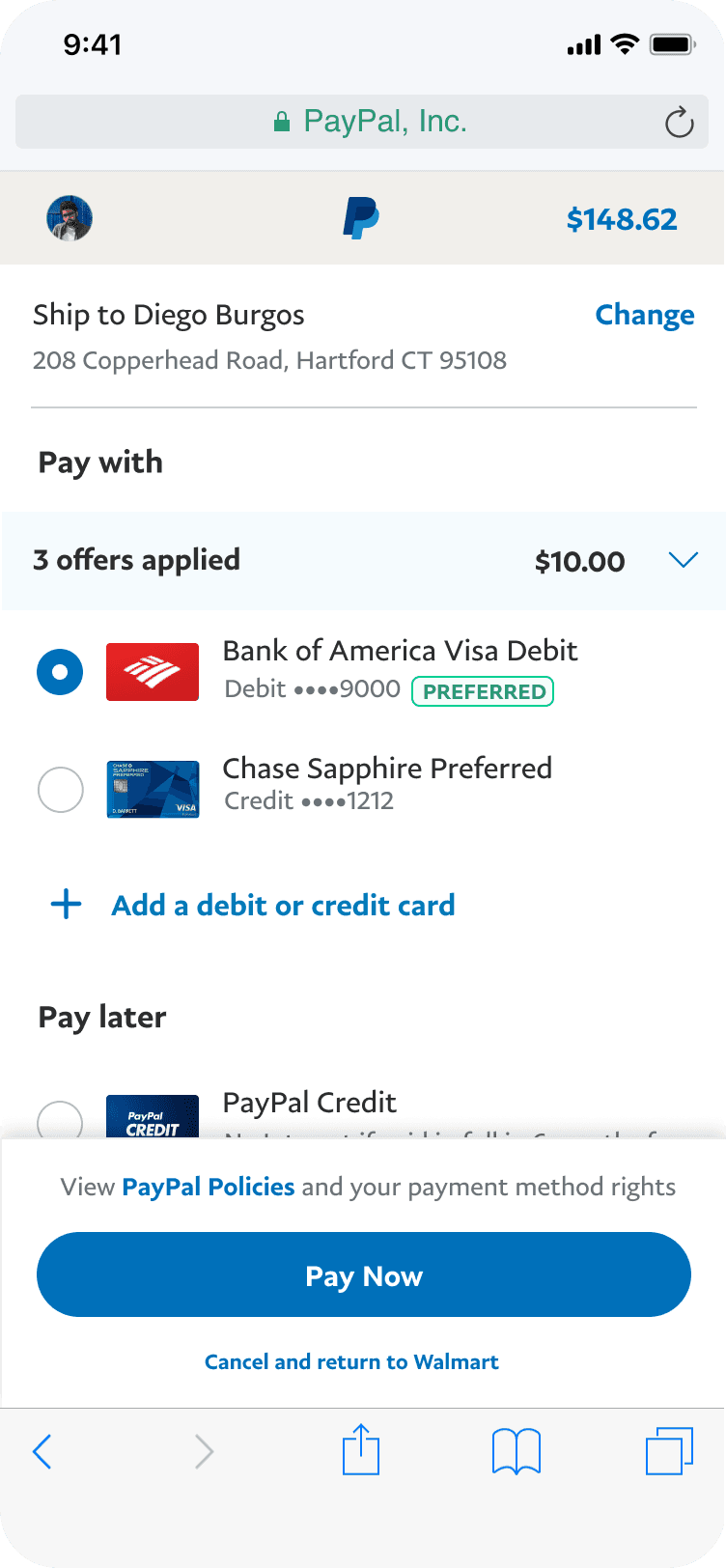

The rise of competitors like Klarna and Afterpay with streamlined credit flows, prompted a critical look at our own checkout experience. With over 30 features, the interface had become dense: Important options like PayPal Credit and flexible payments were buried, impacting discovery and adoption.

Our challenge was to simplify the information architecture, prioritizing key payment methods and integrating all capabilities intuitively, all while preserving behaviors that supported our high conversion rate.

The rise of competitors emphasizing streamlined payment experiences necessitated a critical evaluation of our own checkout flow. Our existing architecture, housing over 30 features, had become dense. A significant portion of the interface was occupied by less critical information, inadvertently obscuring valuable features like PayPal Credit and new flexible payment options. This complexity hindered feature discovery and adoption.

Our challenge was to strategically simplify the information architecture, prioritizing key payment methods and integrating new capabilities intuitively for a broad user base, without disrupting established user behaviors tied to our high conversion rate.

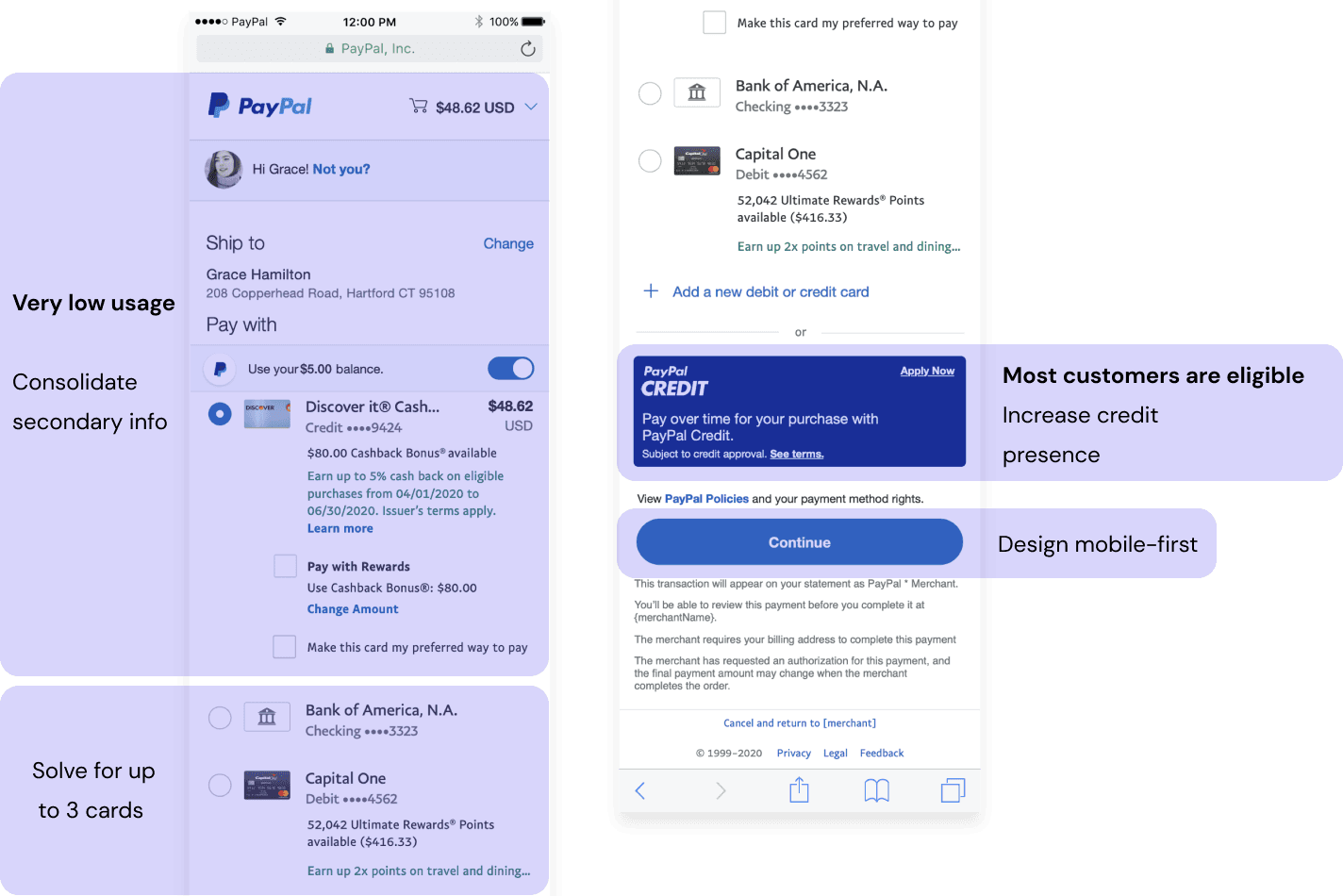

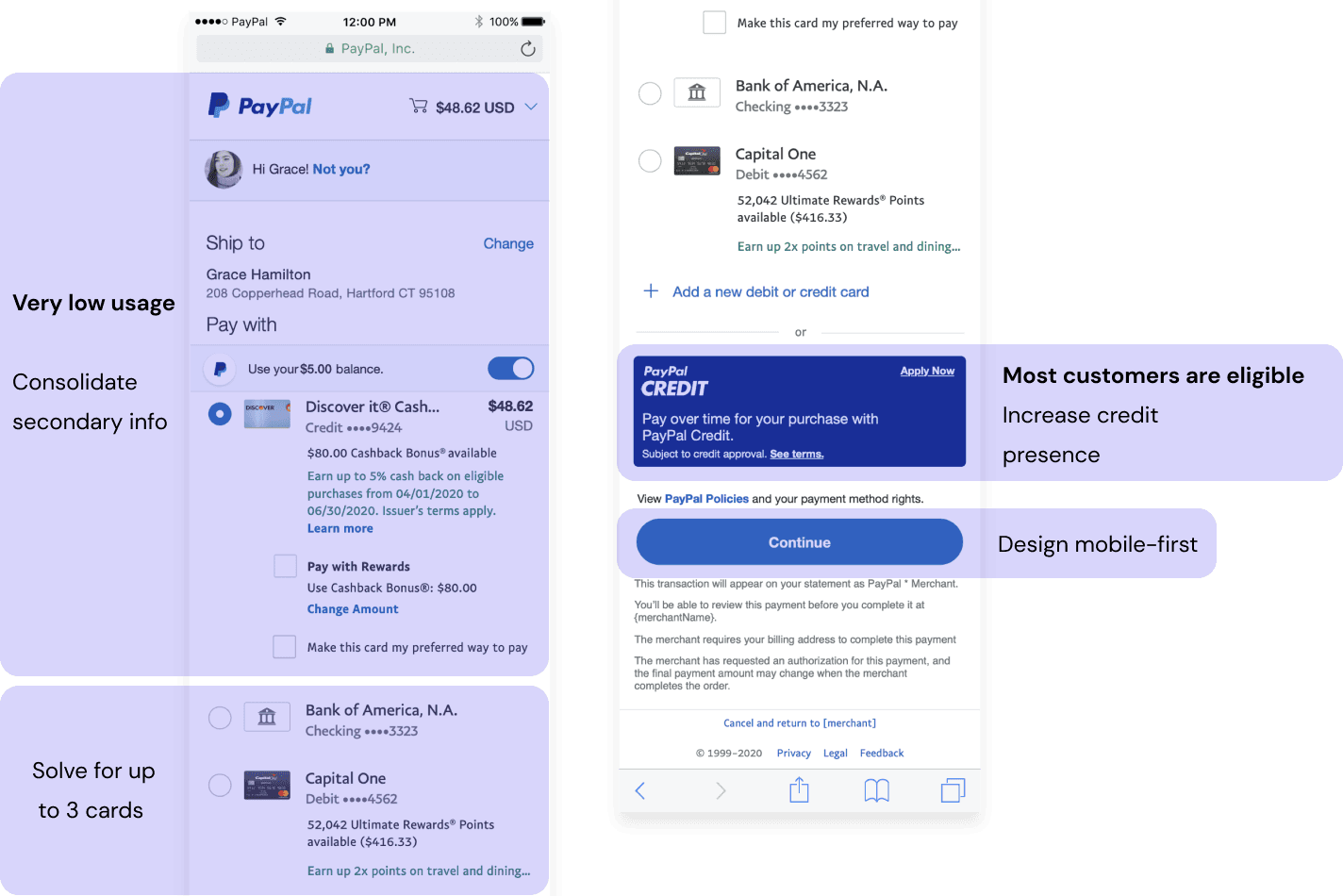

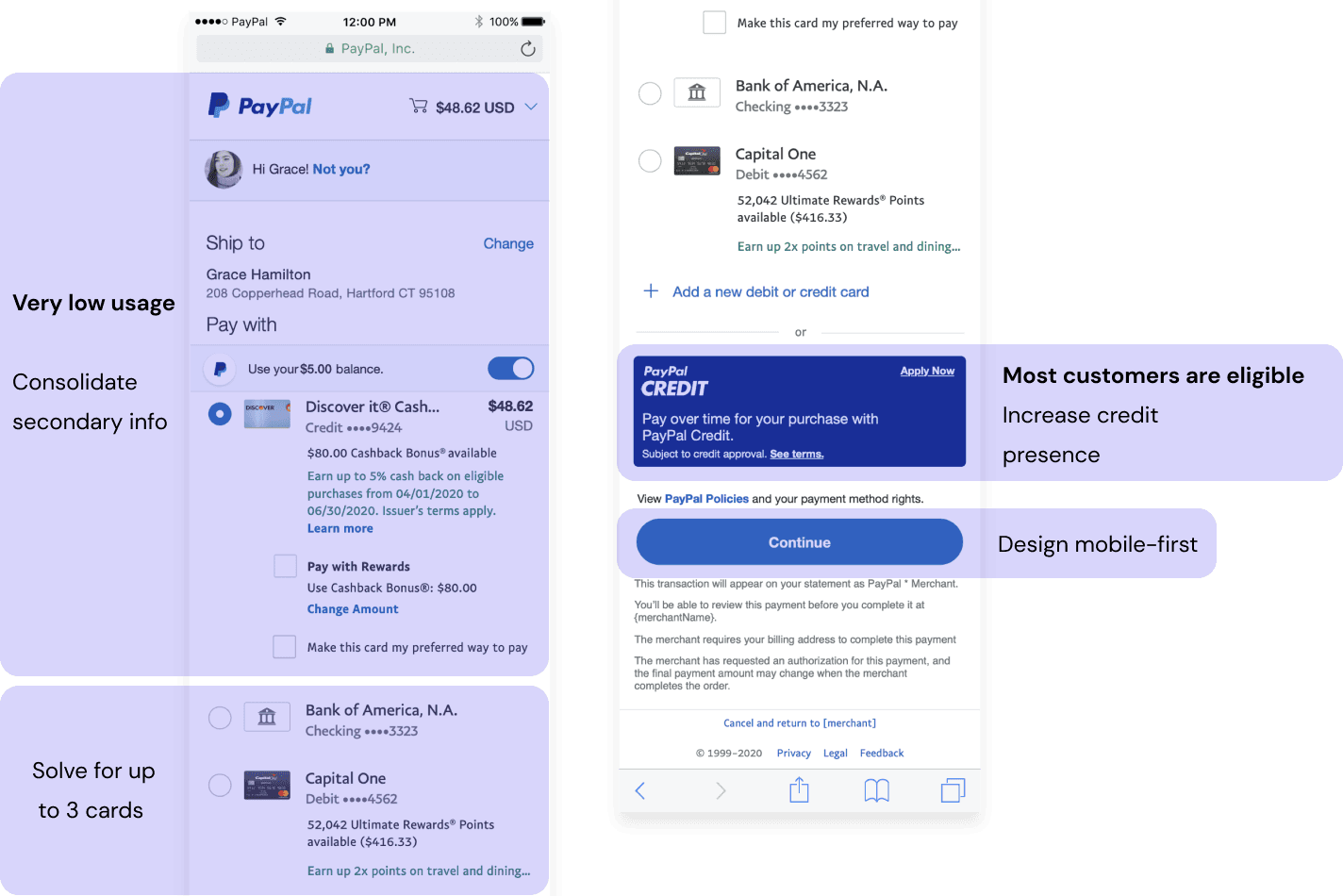

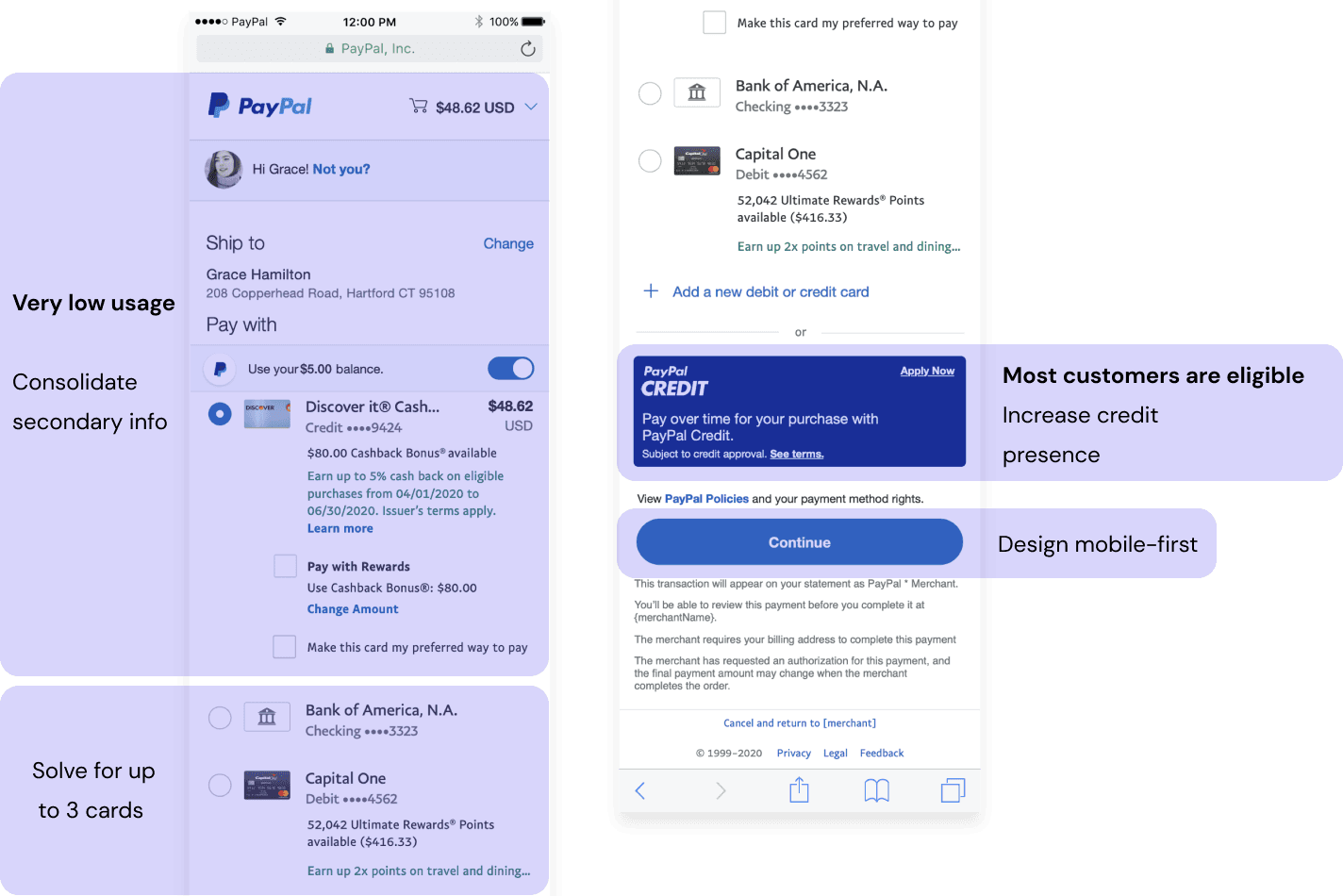

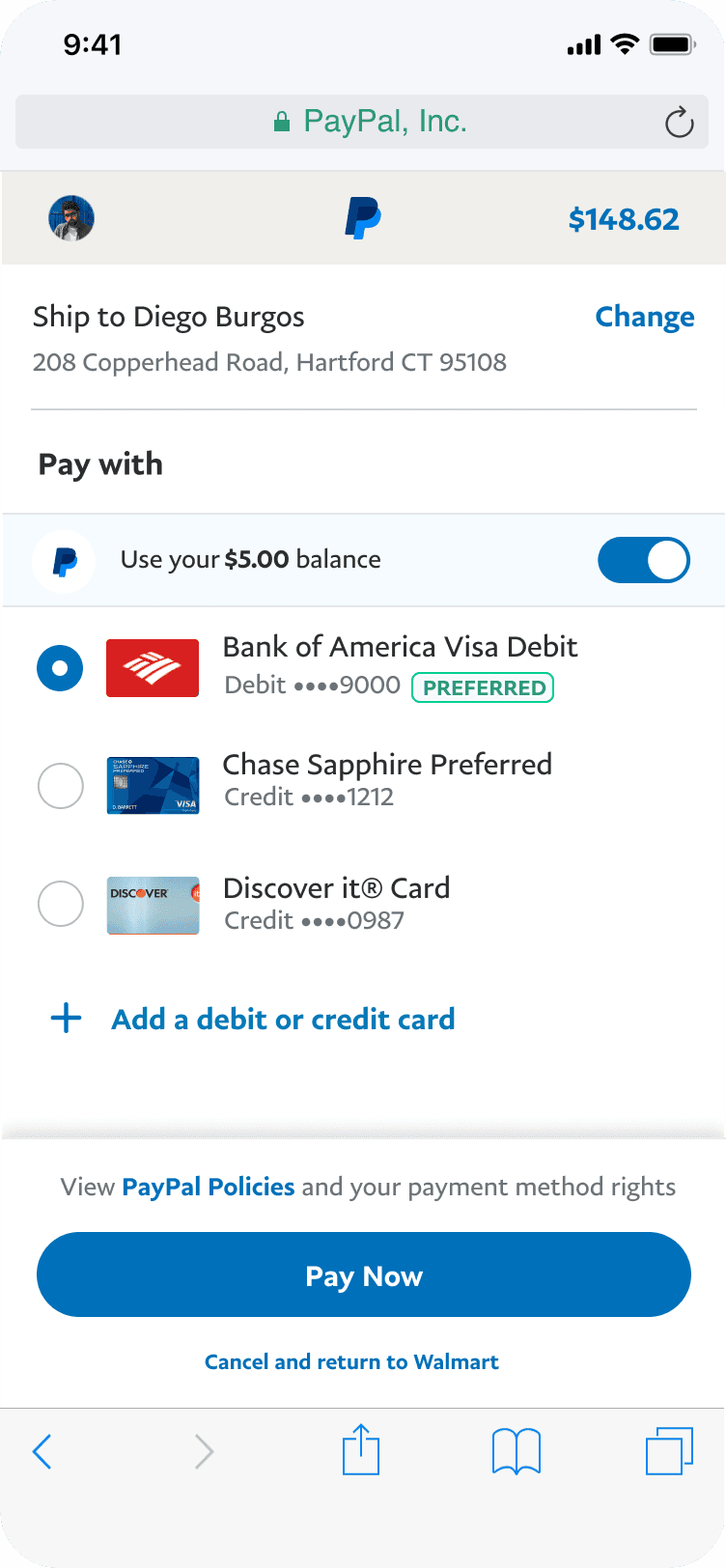

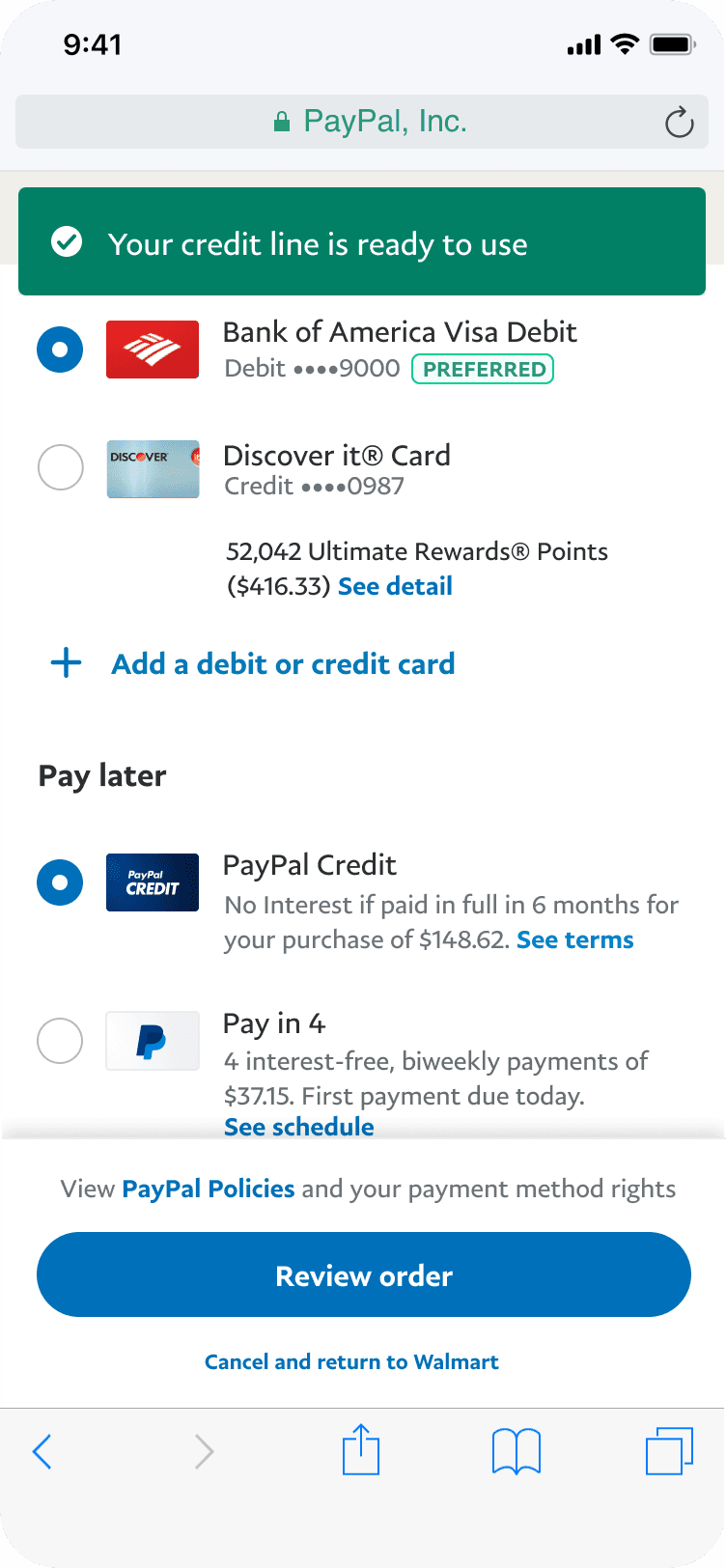

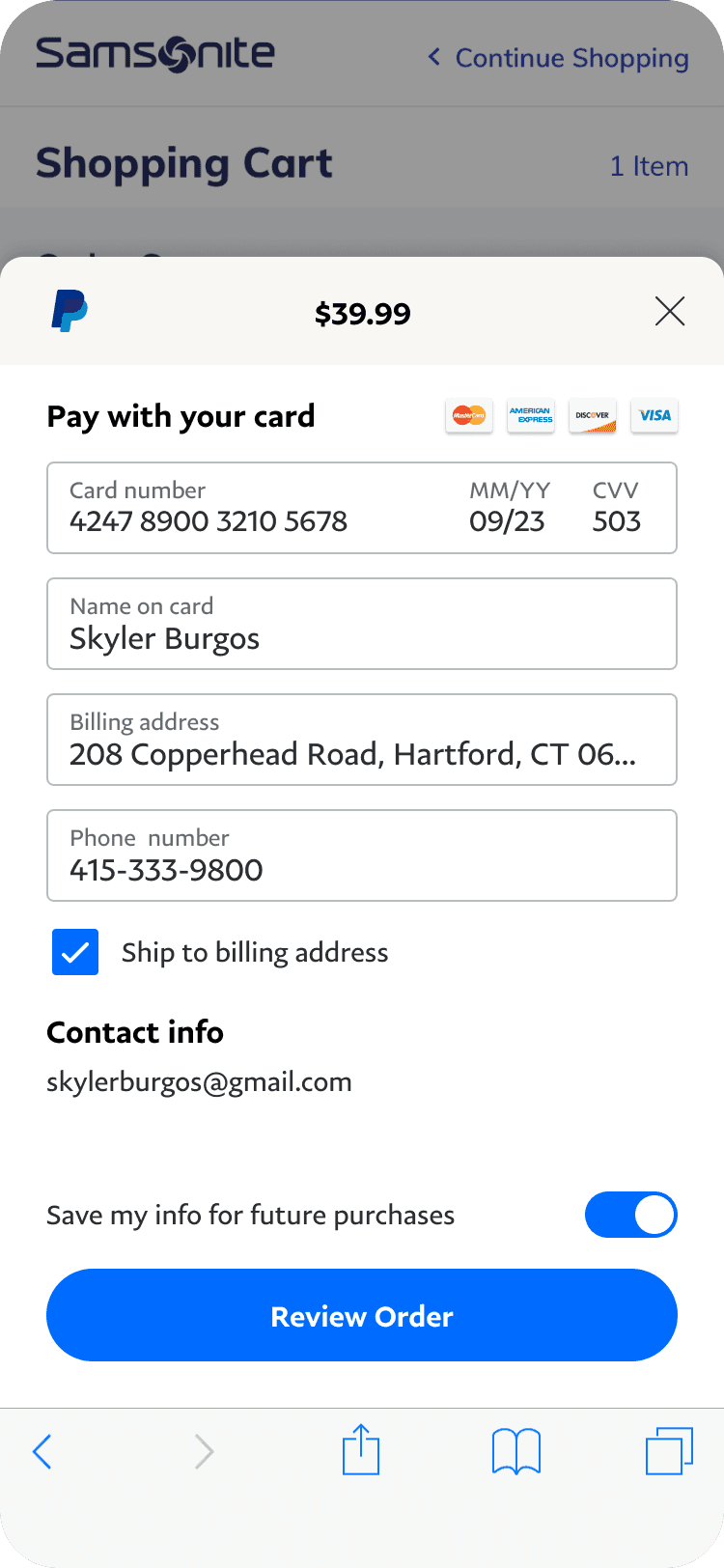

Previous checkout experience

Previous checkout experience

Understanding our customers

Rigorous research, combining user interviews (20 customers with transactions > $140) and behavioral data analysis, provided essential insights to my team:

2 user archetypes with distinct motivations

We identified users primarily driven by security & assurance of correct transactions (Safety-Seekers) and those focused on value maximization and money savings (Optimizers).

Information overload

Data underscored that nearly half the checkout screen was consumed by secondary and tertiary information, overwhelming users and causing them to stick to 1-2 cards to transact and not explore beyond this safety zone.

Principles

Our strategic approach was built on three foundational principles:

Efficiency

Optimizing the flow to minimize cognitive load.

Choice

Presenting payment options clearly and facilitating informed decisions.

Confidence

Instilling user confidence through transparency and reliability.

Exploration and iteration

Collaborative workshops with product and engineering partners allowed us to map the complex feature landscape and develop design concepts aligned with user mental models:

Inline Design: A more conventional, vertical layout emphasizing clarity and familiarity, for safety-seekers.

Carousel Design: The carousel pattern widely used across PayPal, solves for choice and satisfies optimizers.

I worked on both designs simultaneously to run stress-tests and iterative usability testing comparing these concepts while balancing stakeholder feedback. We had supporters and detractors for both designs.

Overall, the carousel design demonstrated to be the most exciting for users, but also had a learning curve.

Blueprints

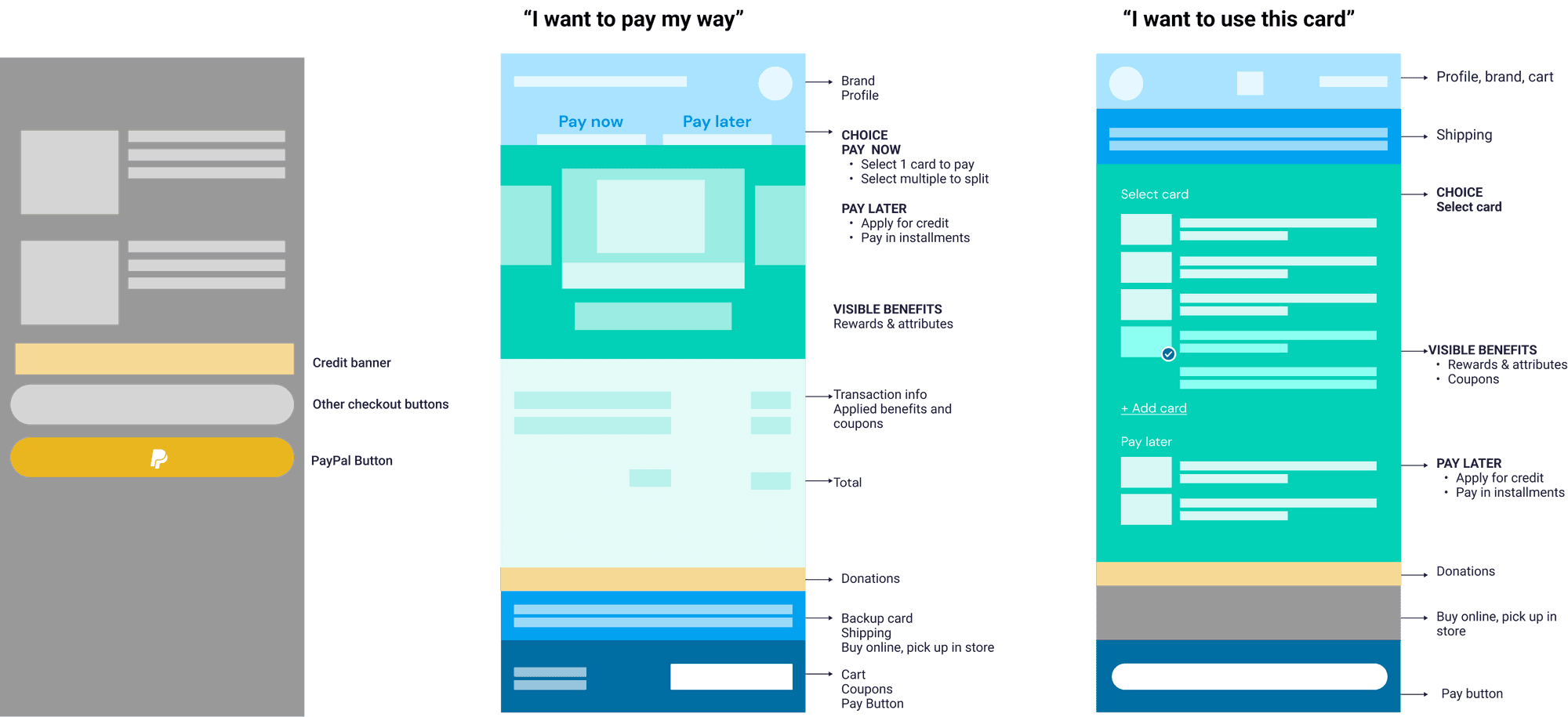

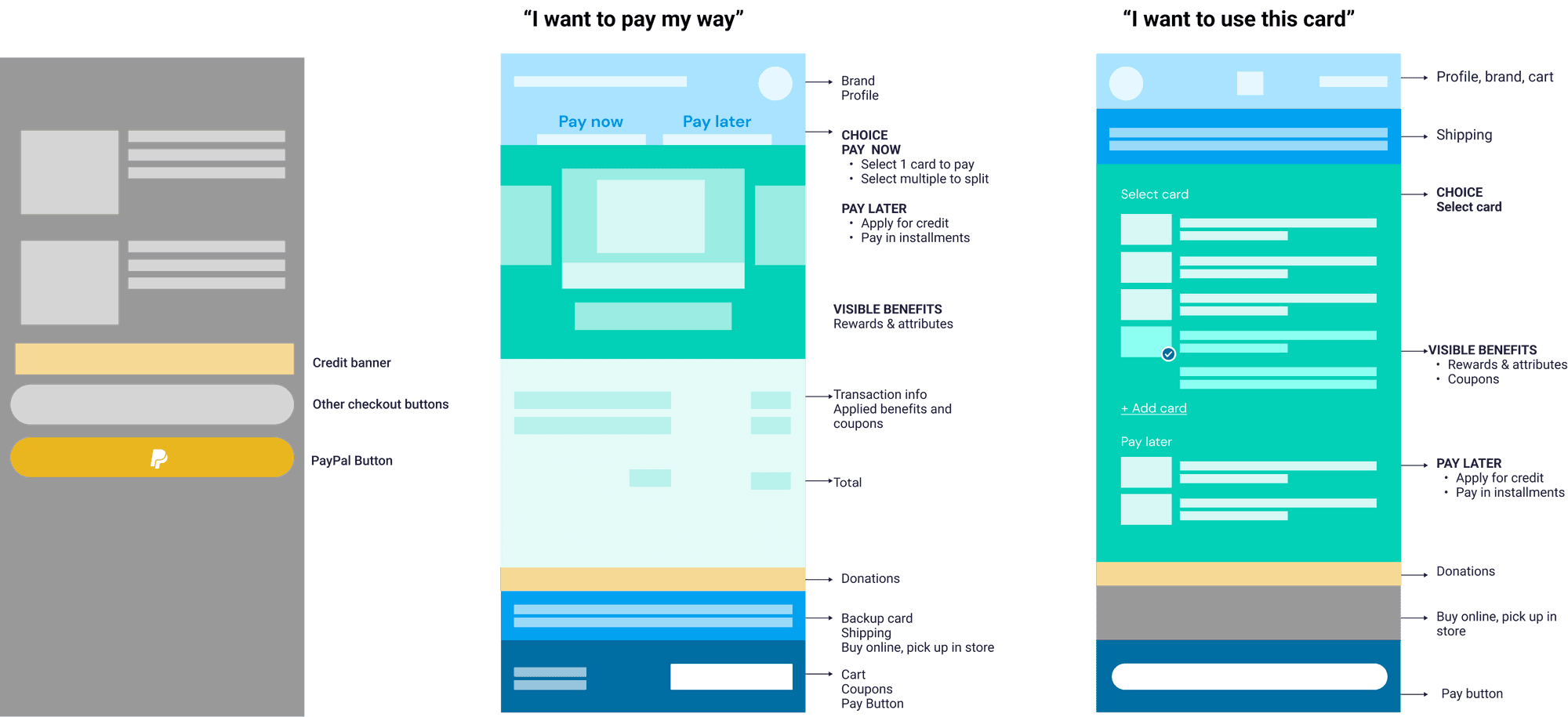

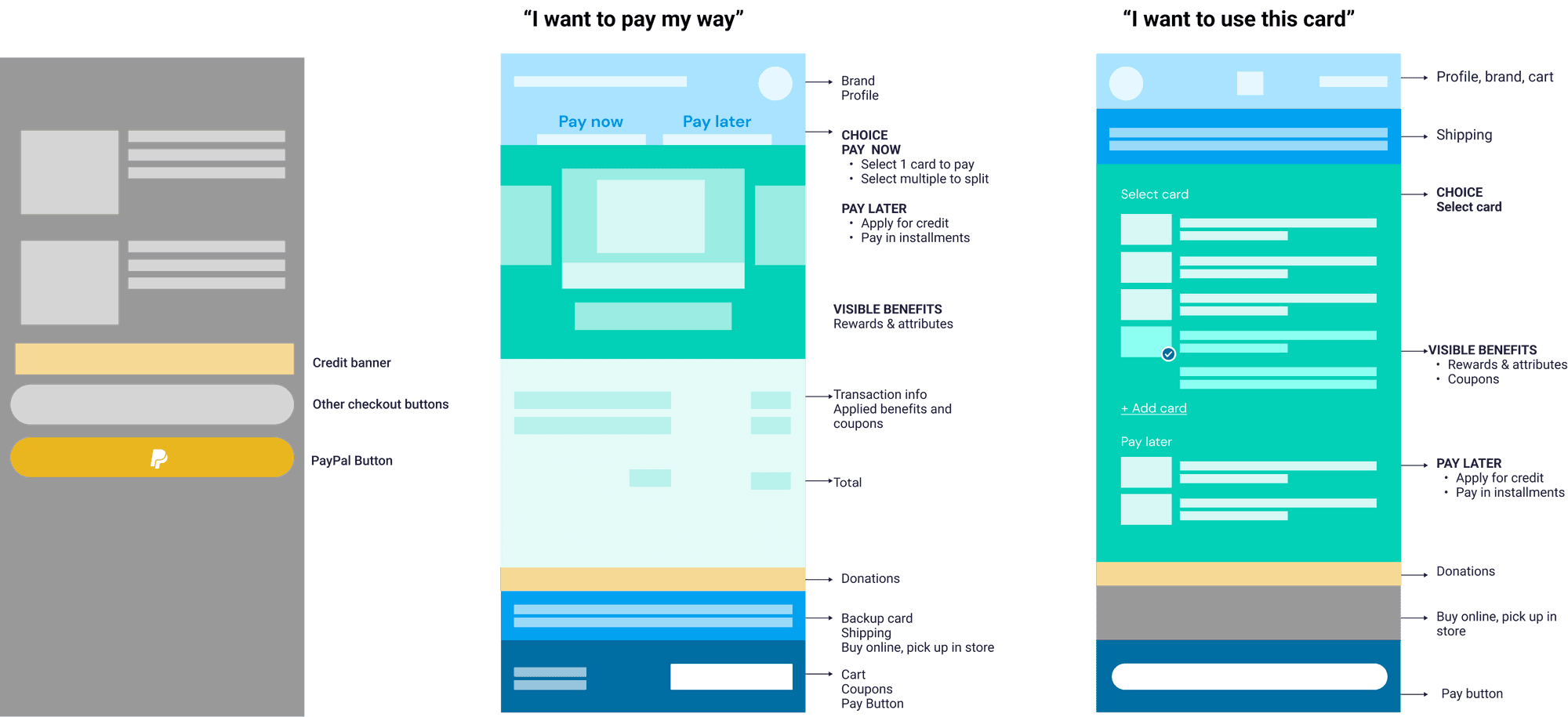

Initial blueprint explorations allowed us to identify how to organize +30 features

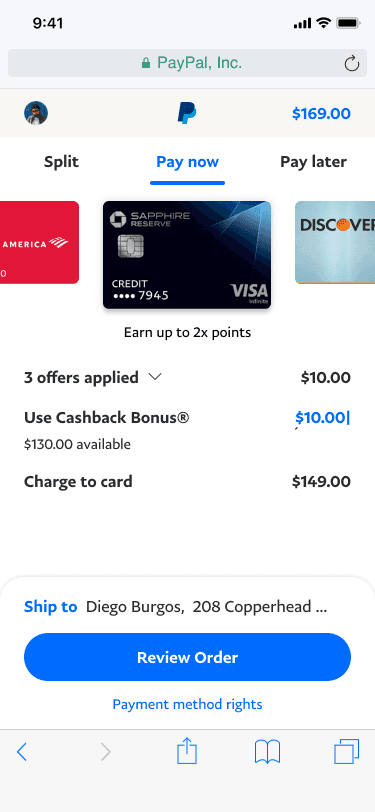

Carousel design

Early: Highlight benefits

Mid: Focus on transaction info

Mid:: Focus on transaction info

Mid: Focus on transactions

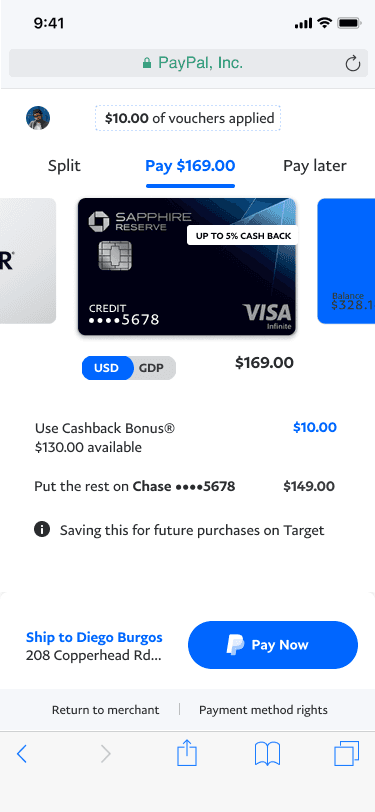

Final concept: Less is more

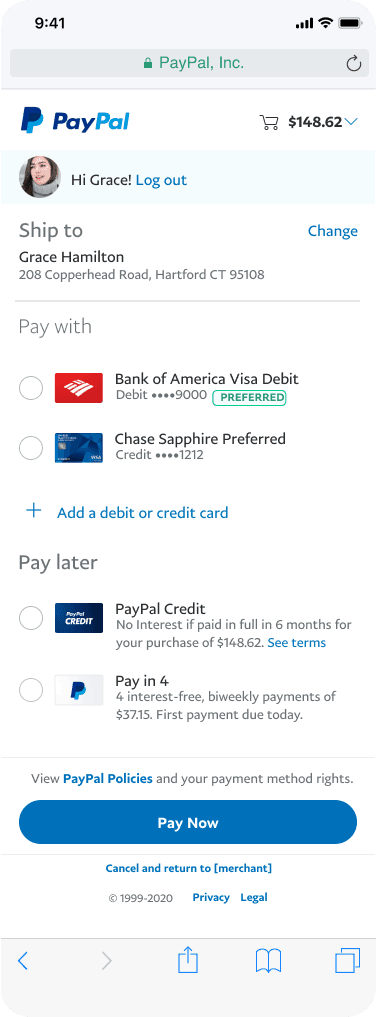

Inline design

Early: Integrate split payments

Mid: Focus on credit products only

Final: Consolidate low usage info

UXR and live testing

I conducted 4 rounds of iterative user testing comparing these concepts. We ruled out concerns regarding reduced content and use of progressive disclosure in both designs, and the use of tabs in the carousel design. Internal excitement for the carousel design, and uncertainty about technical feasibility pointed out to a need for a live prototype and testing.

I helped follow up with a live implementation coordinating batched spec delivery and reviews every week with engineering, and an invitation-only beta testing amongst 100 users in partnership with UXR and marketing teams.

Inline design feedback

Proved to be successful due to familiarity with the old design, while showing only what customers needed to transact.

Carousel user feedback

The carousel had interesting elements and provoked excitement. Customers felt surprised about the drastic UI change.

Strategic pivot

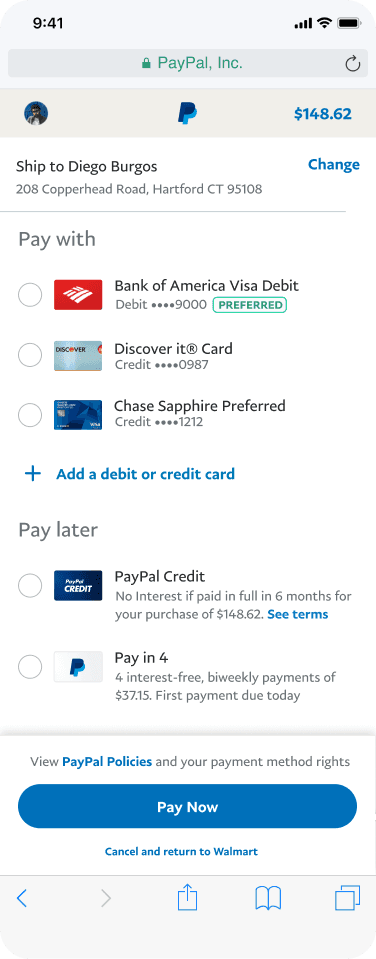

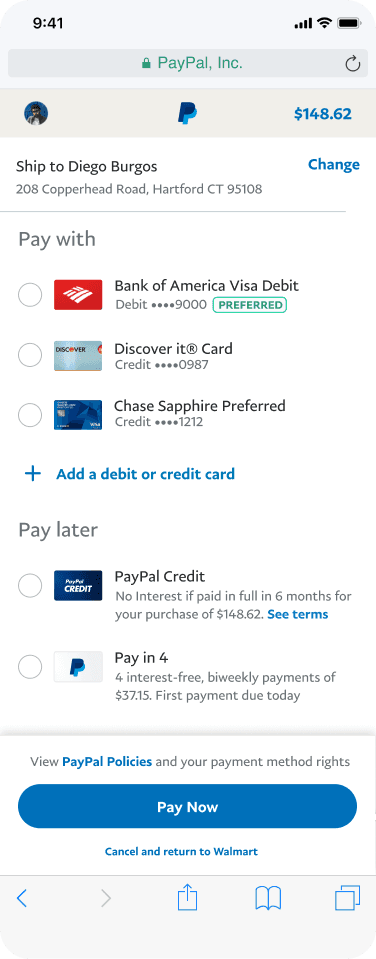

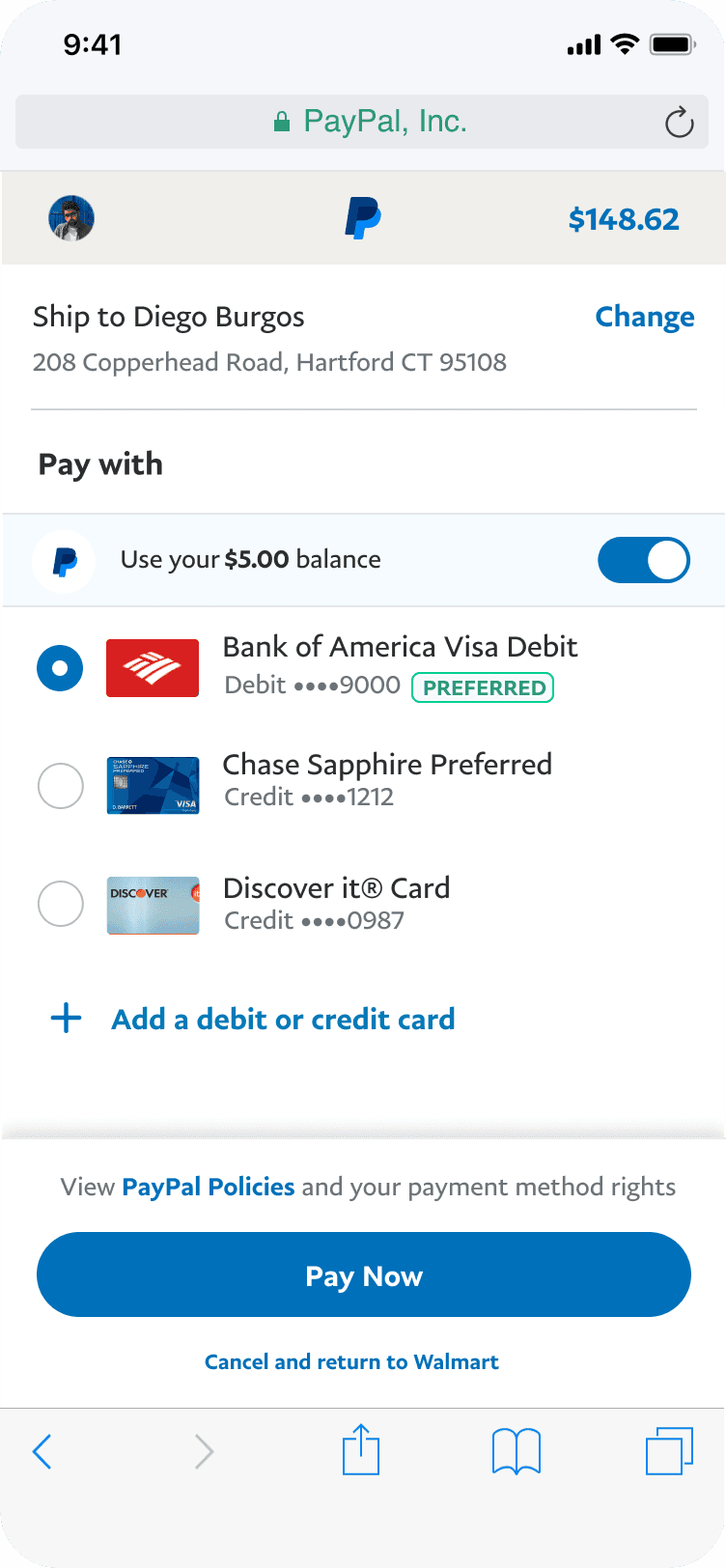

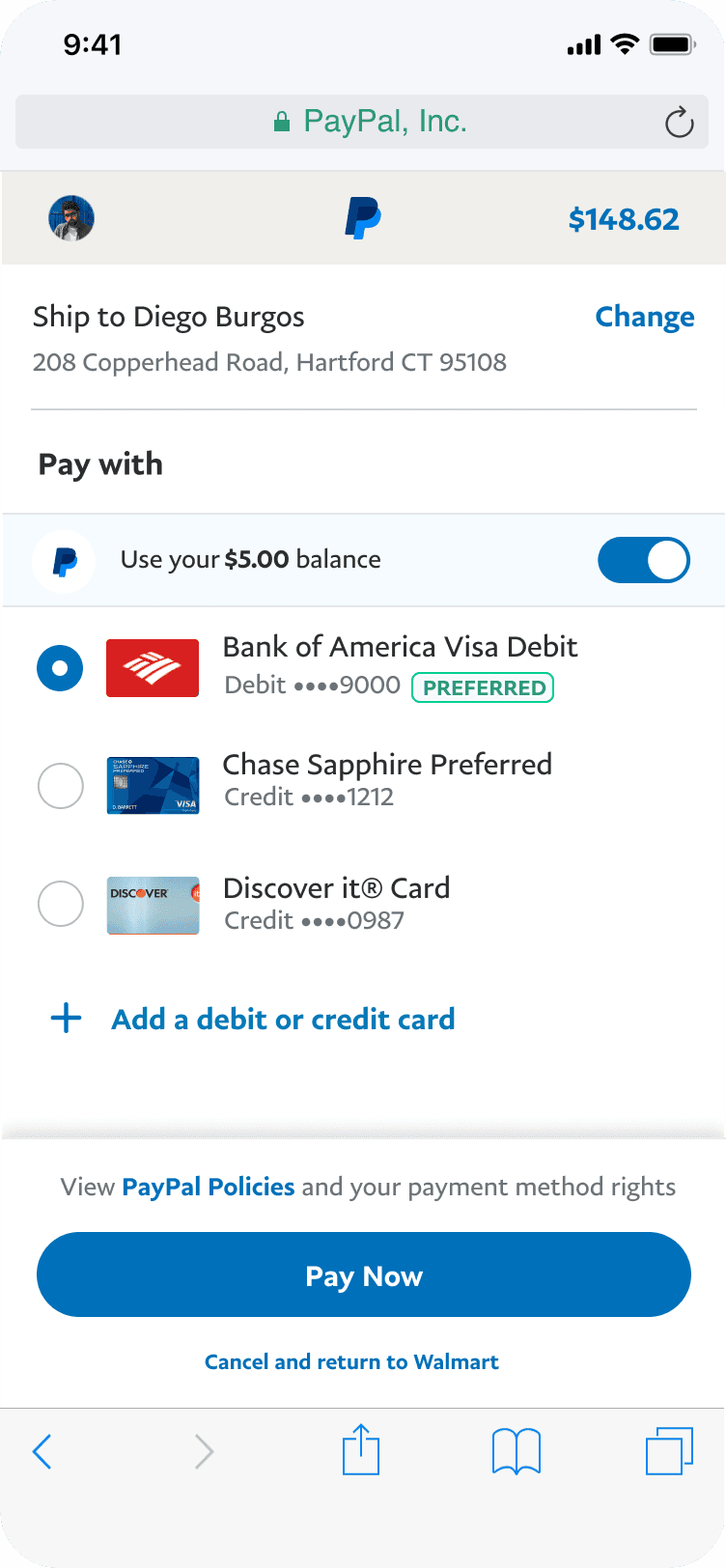

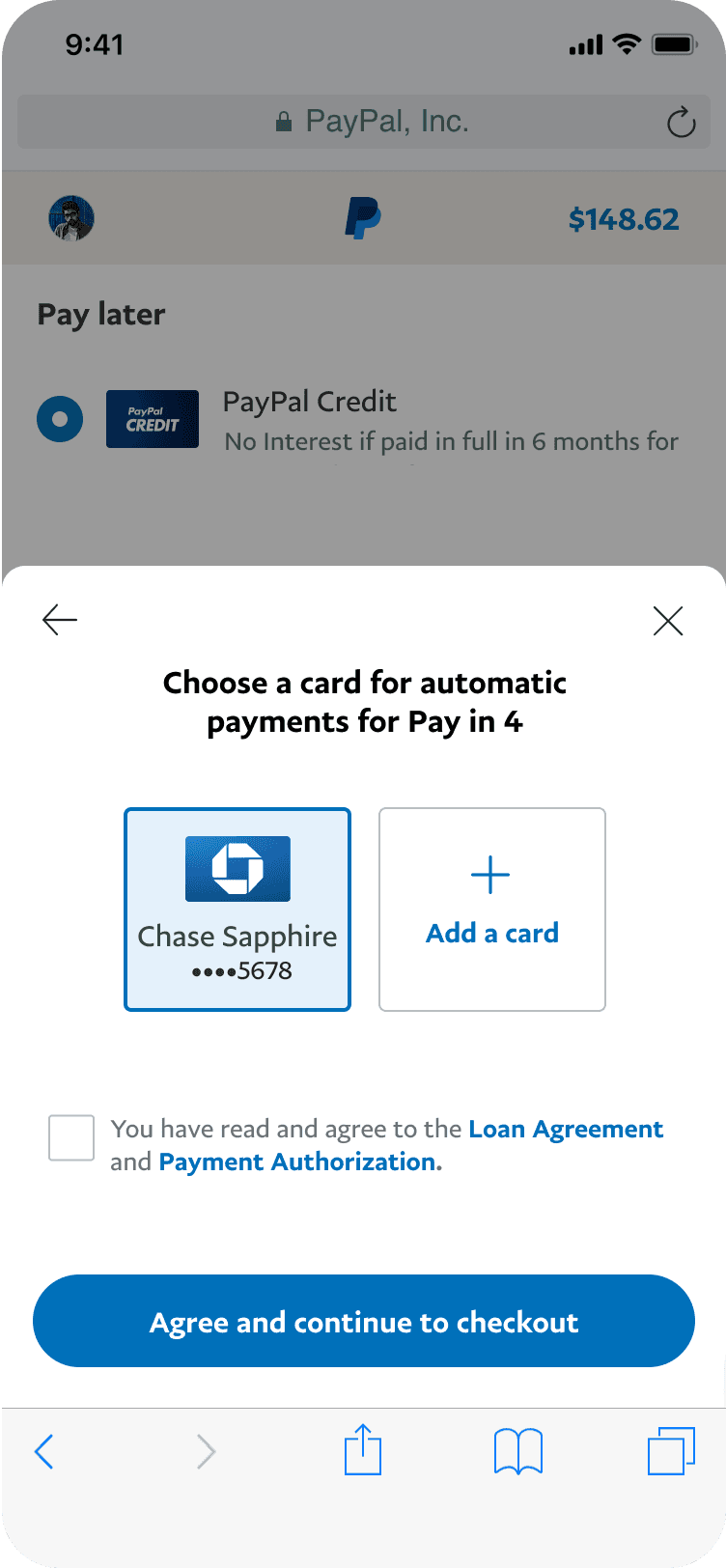

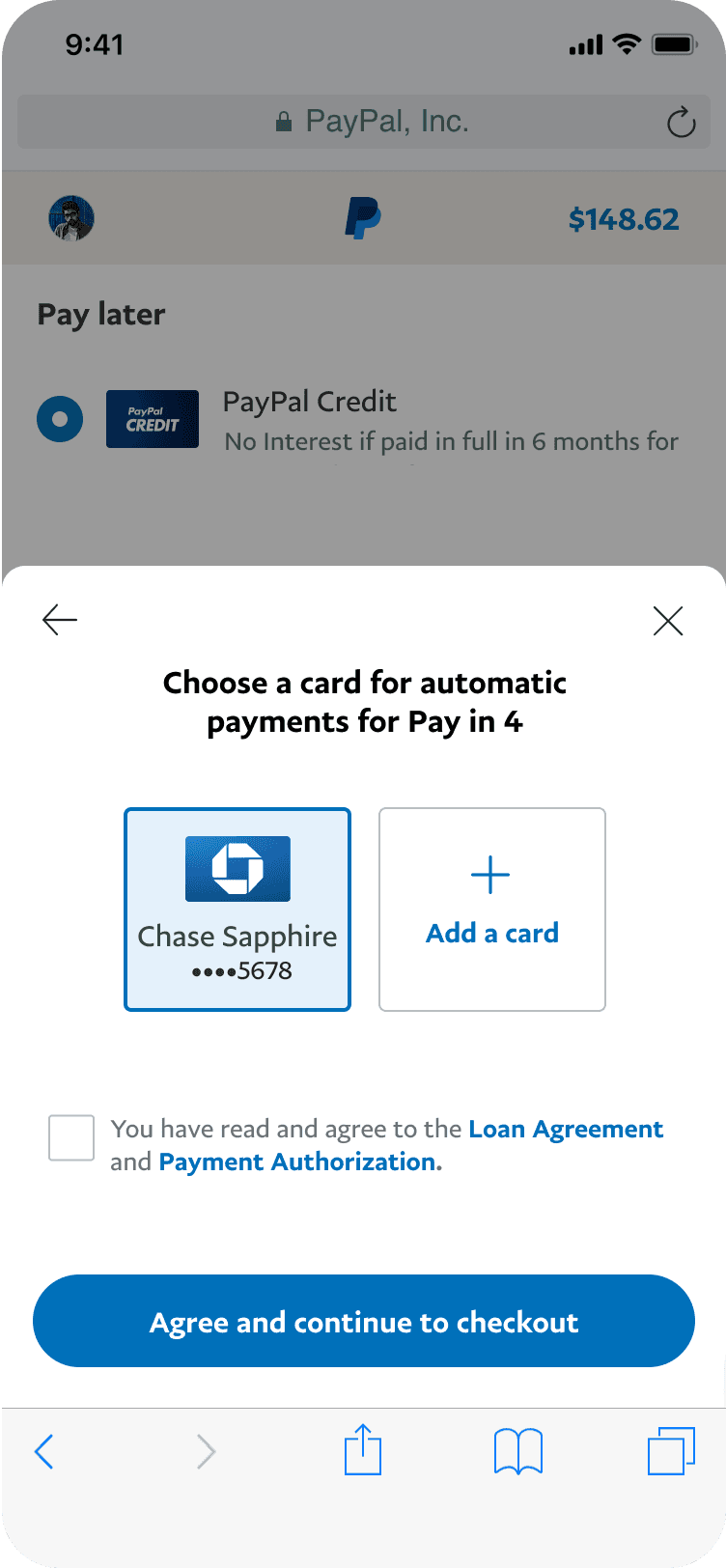

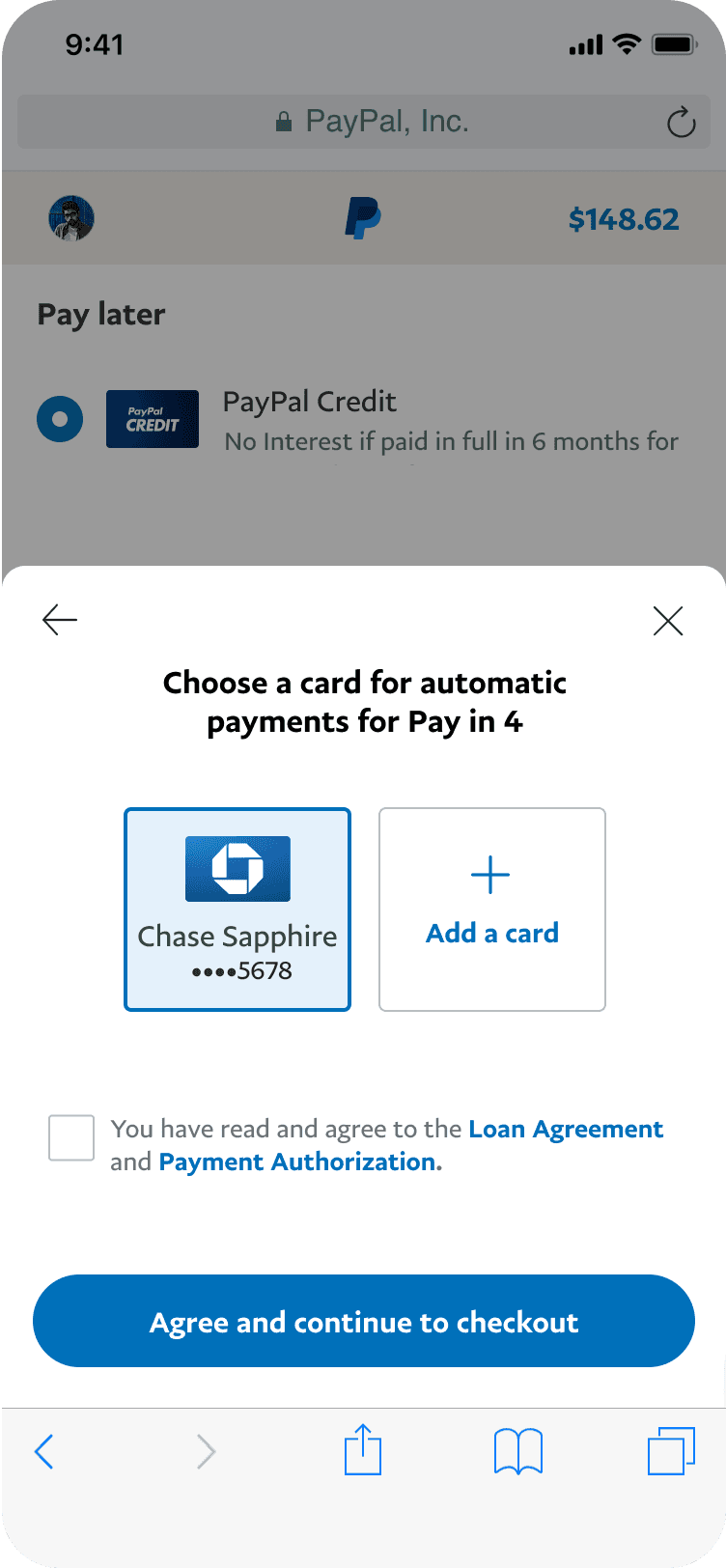

Based on decisive user feedback and a pragmatic assessment of implementation feasibility and risk, we made the strategic decision to proceed with the Inline design. We consciously integrated successful interaction patterns proven in testing from the Carousel concept, such as the intuitive handling of split payments and the use of modal sheets for secondary information, achieving a balance between innovation and user comfort.

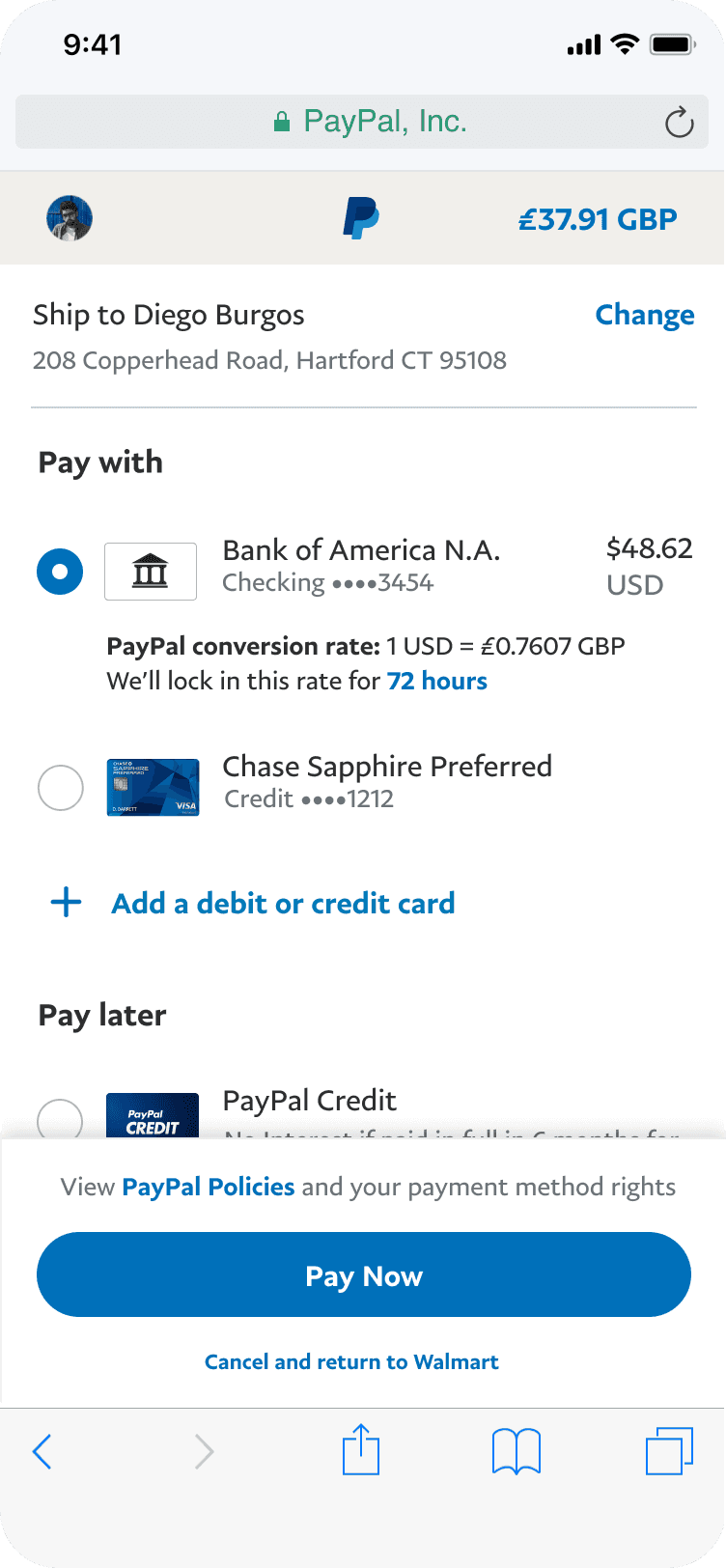

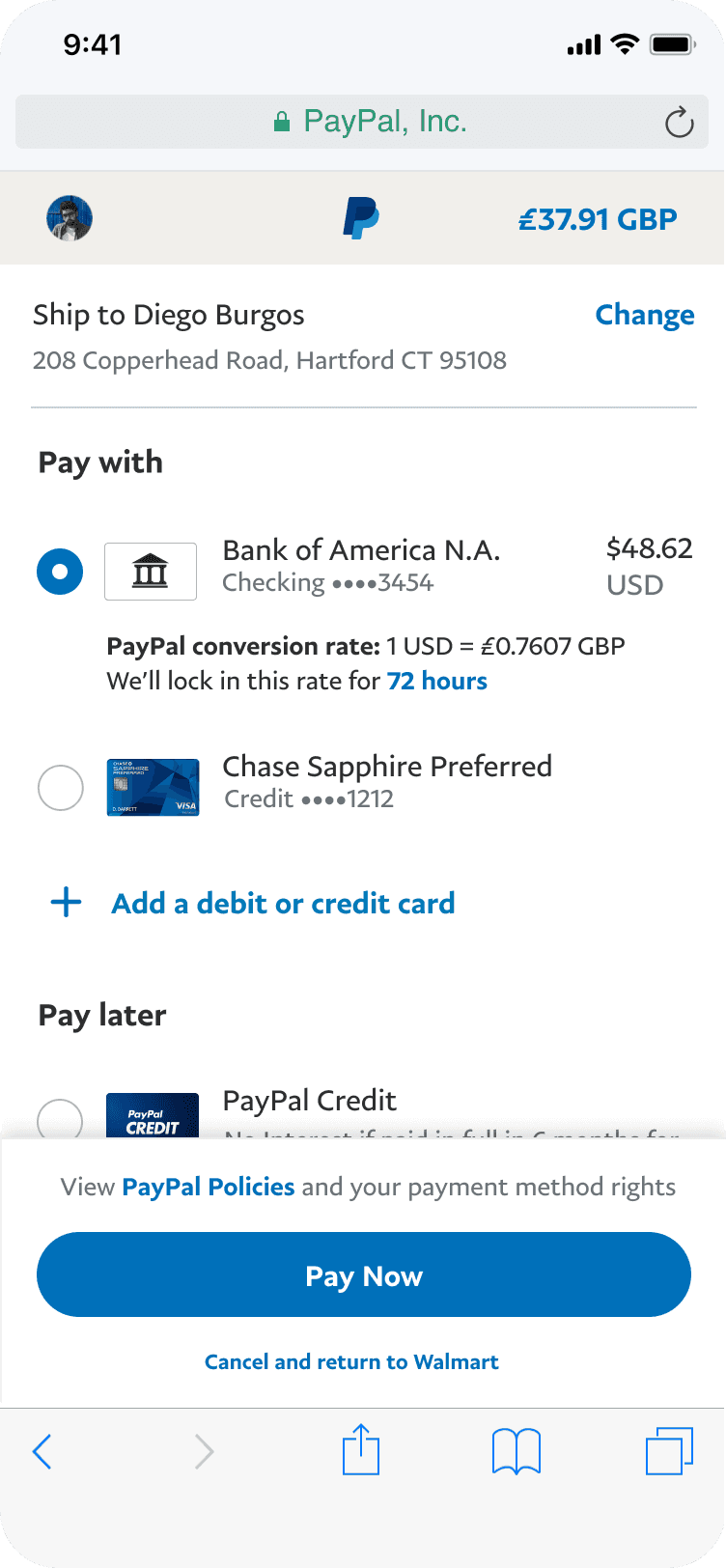

Cross-functional collaboration

The subsequent phase involved deep collaboration across design, product, and engineering teams to refine every aspect of the chosen design. We systematically addressed complex use cases and technical requirements. Key areas of focus included:

Standardizing payment method presentation

Developing key use cases like handling offers, PayPal balance, foreign accounts and errors. (my ownership)

Designing the progressive disclosure of secondary information.

Integrating credit product flows (my ownership)

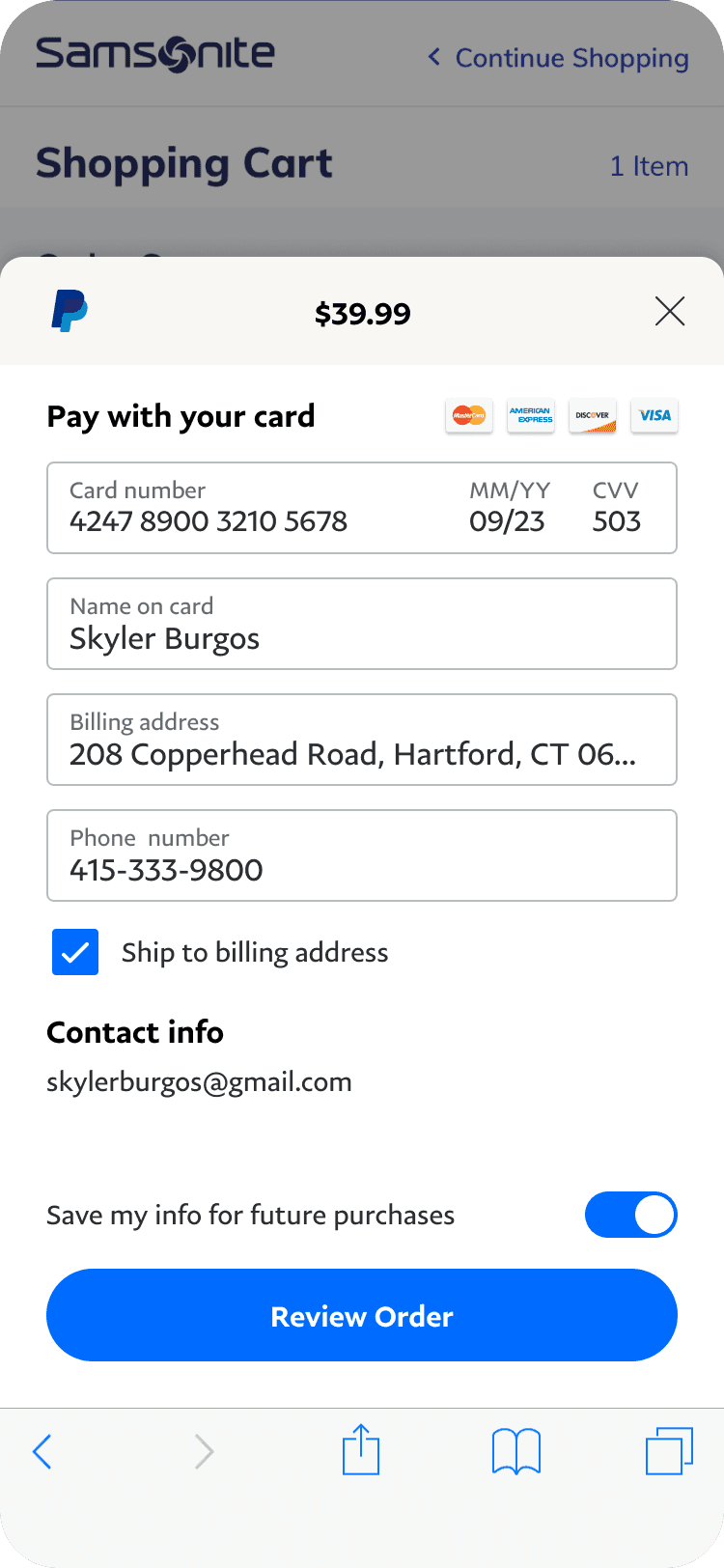

Optimizing the Guest Checkout Experience (my ownership).

Ensuring compatibility with the three SDKs to migrate.

This phase required meticulous design work and close partnership to translate strategy into a shippable product.

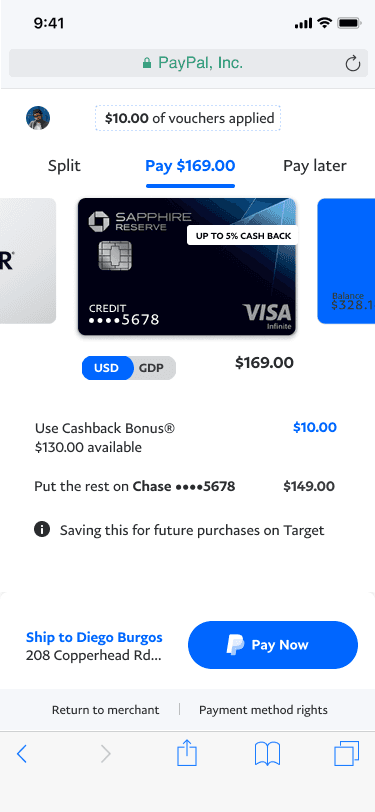

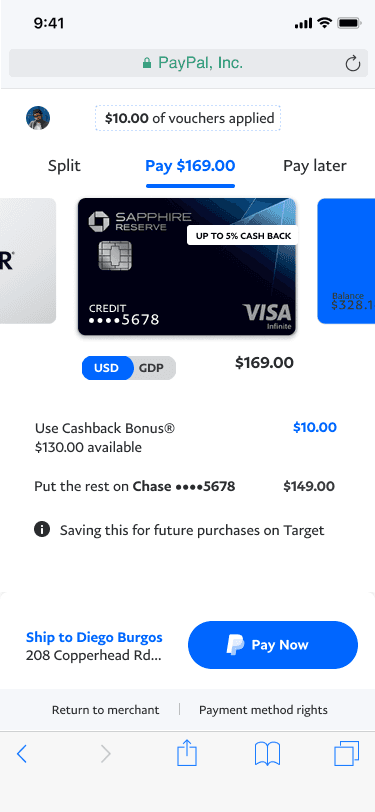

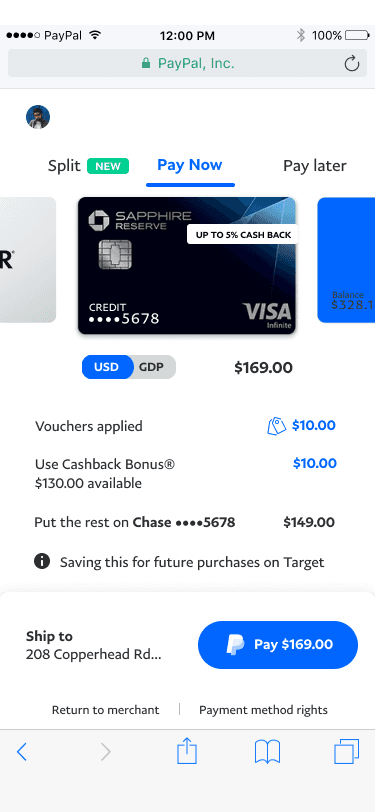

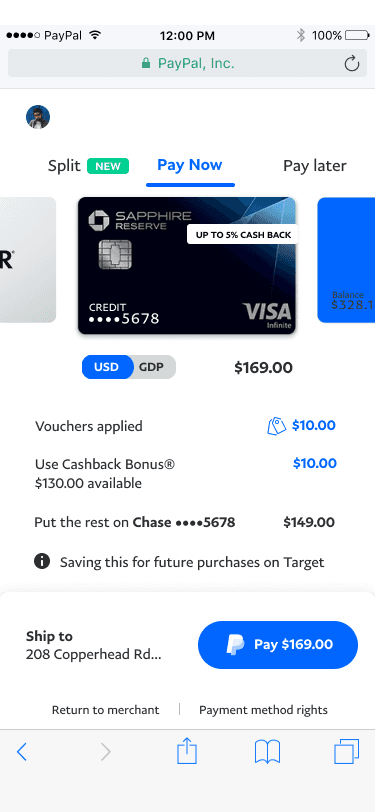

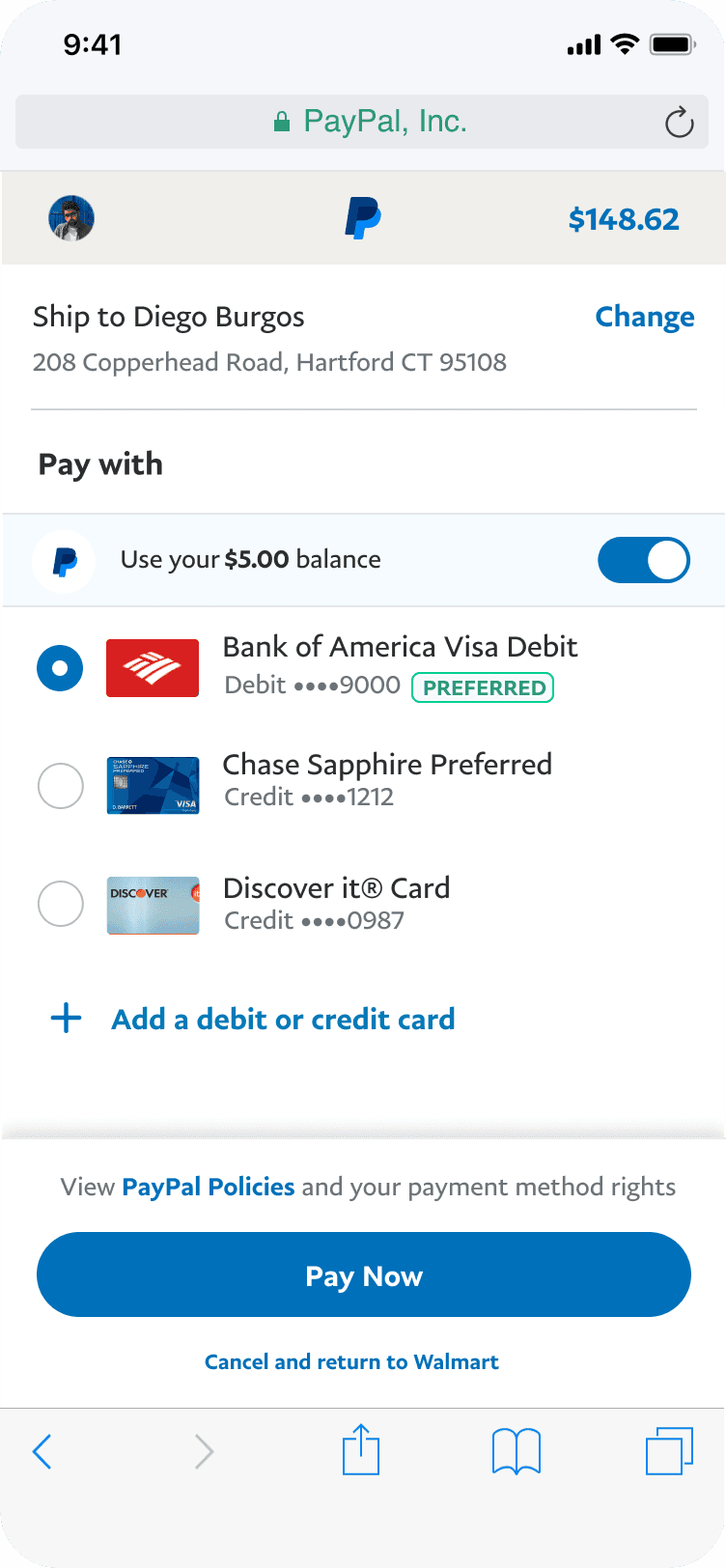

Using a PayPal balance

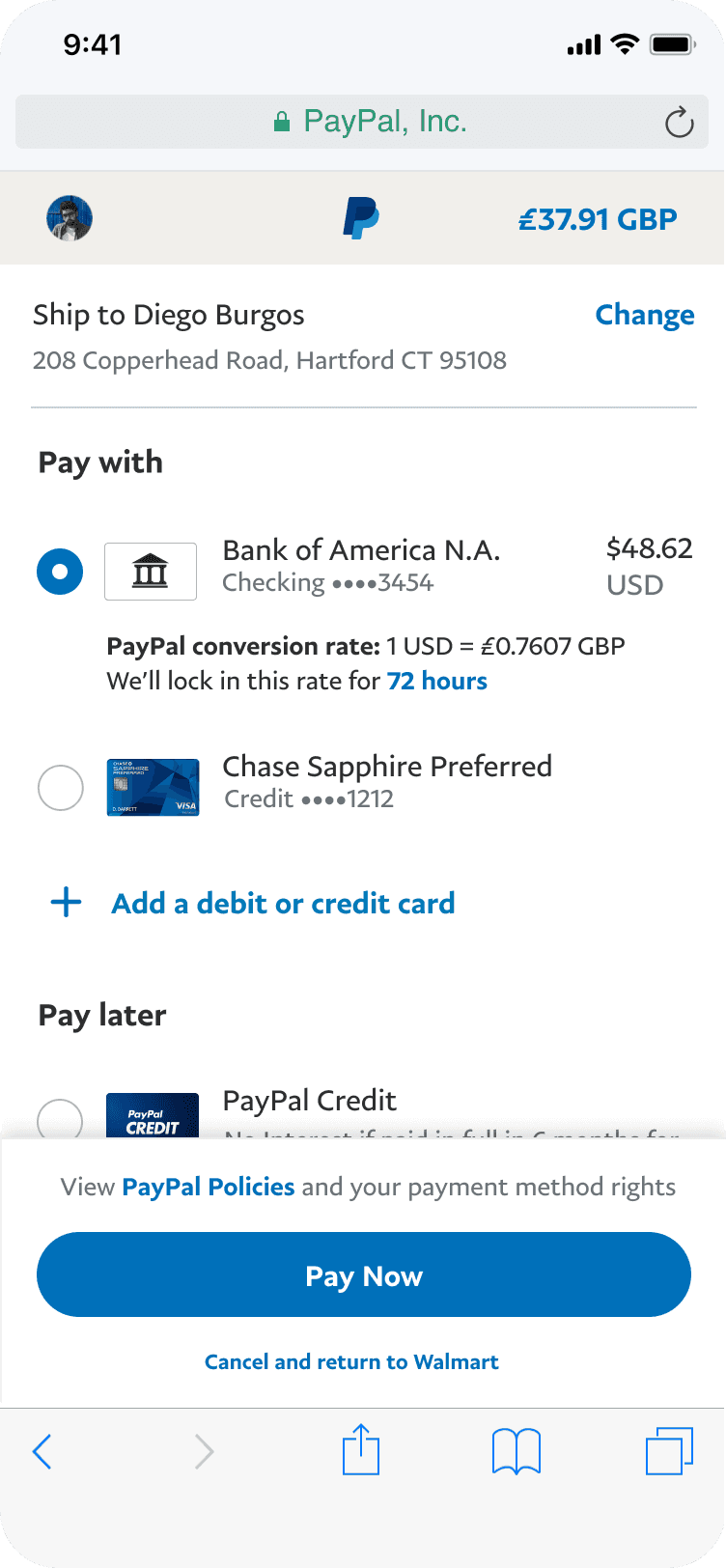

Foreign cards & conversion rate

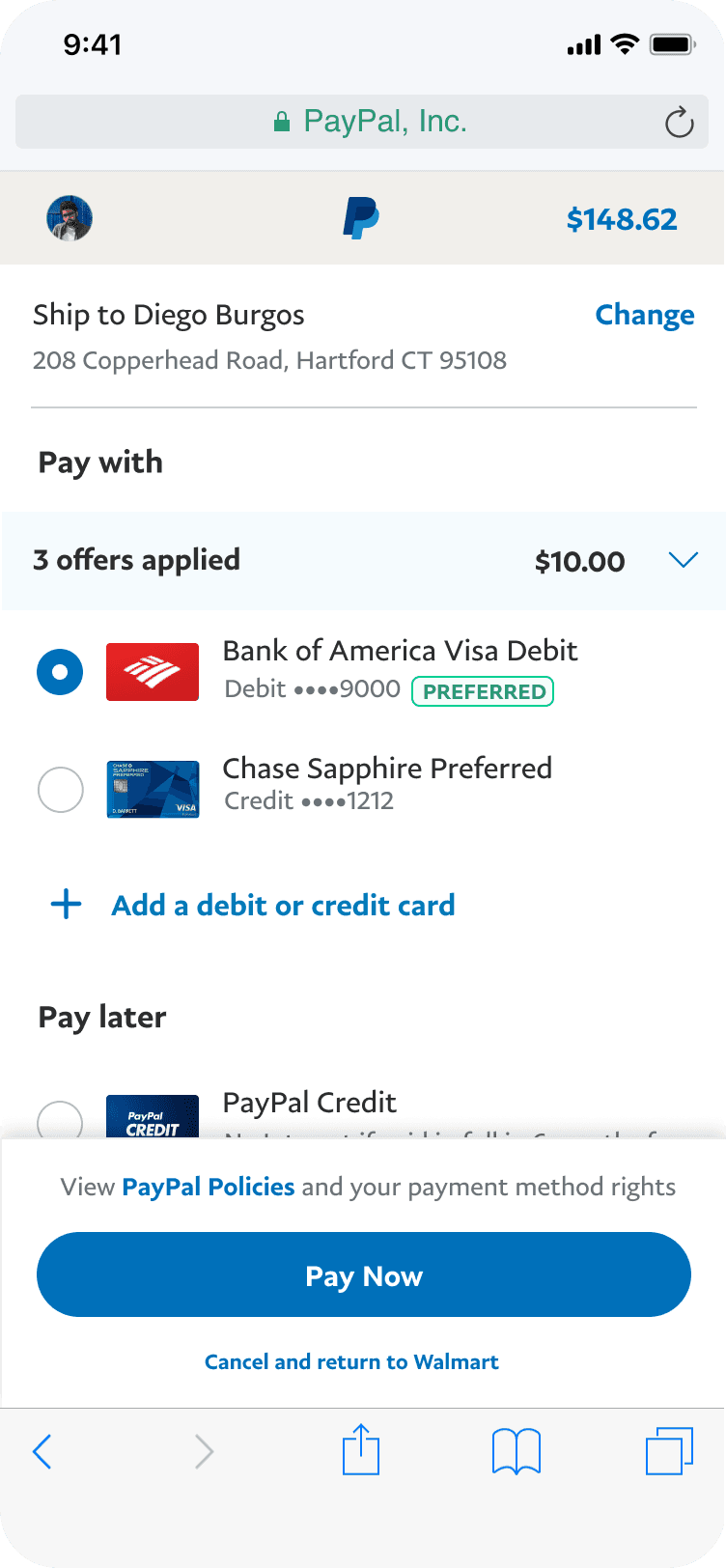

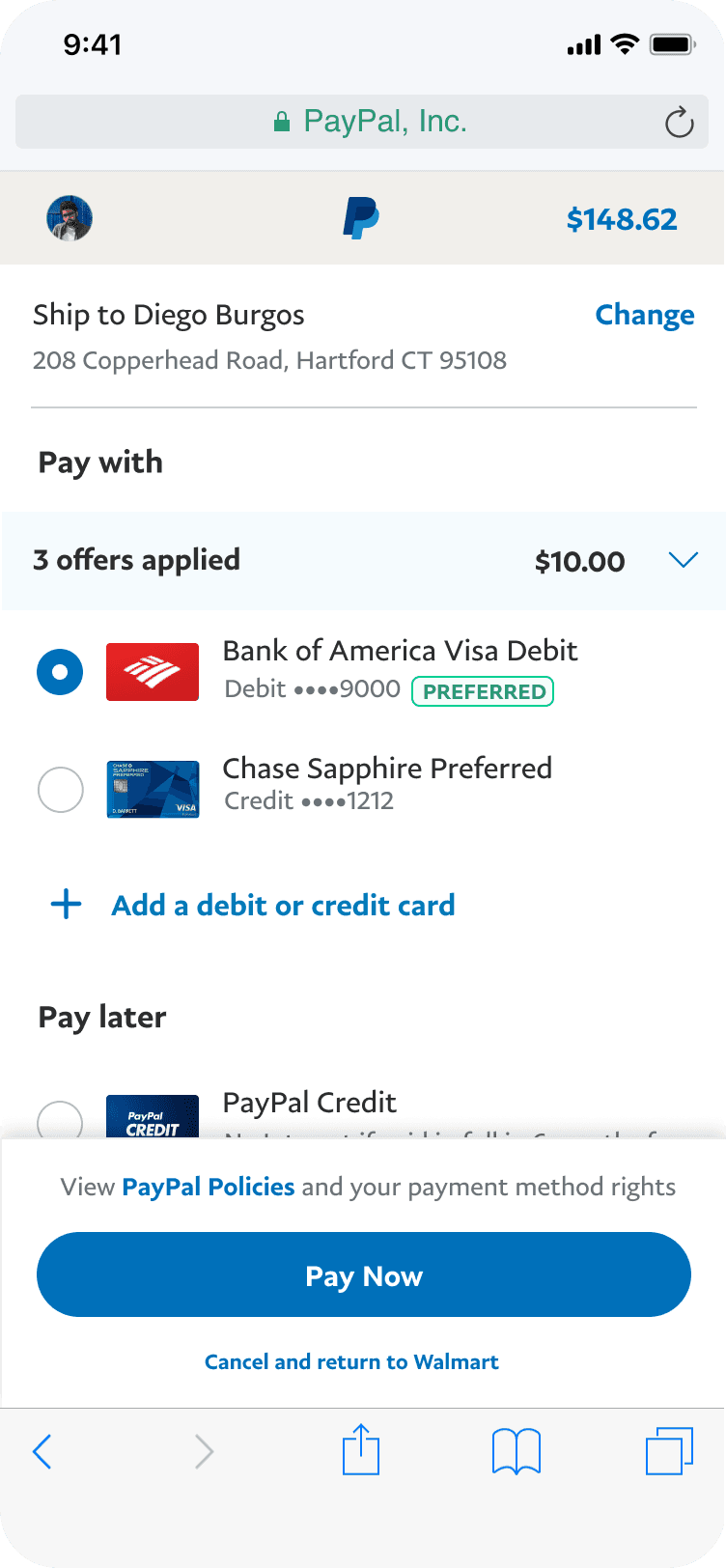

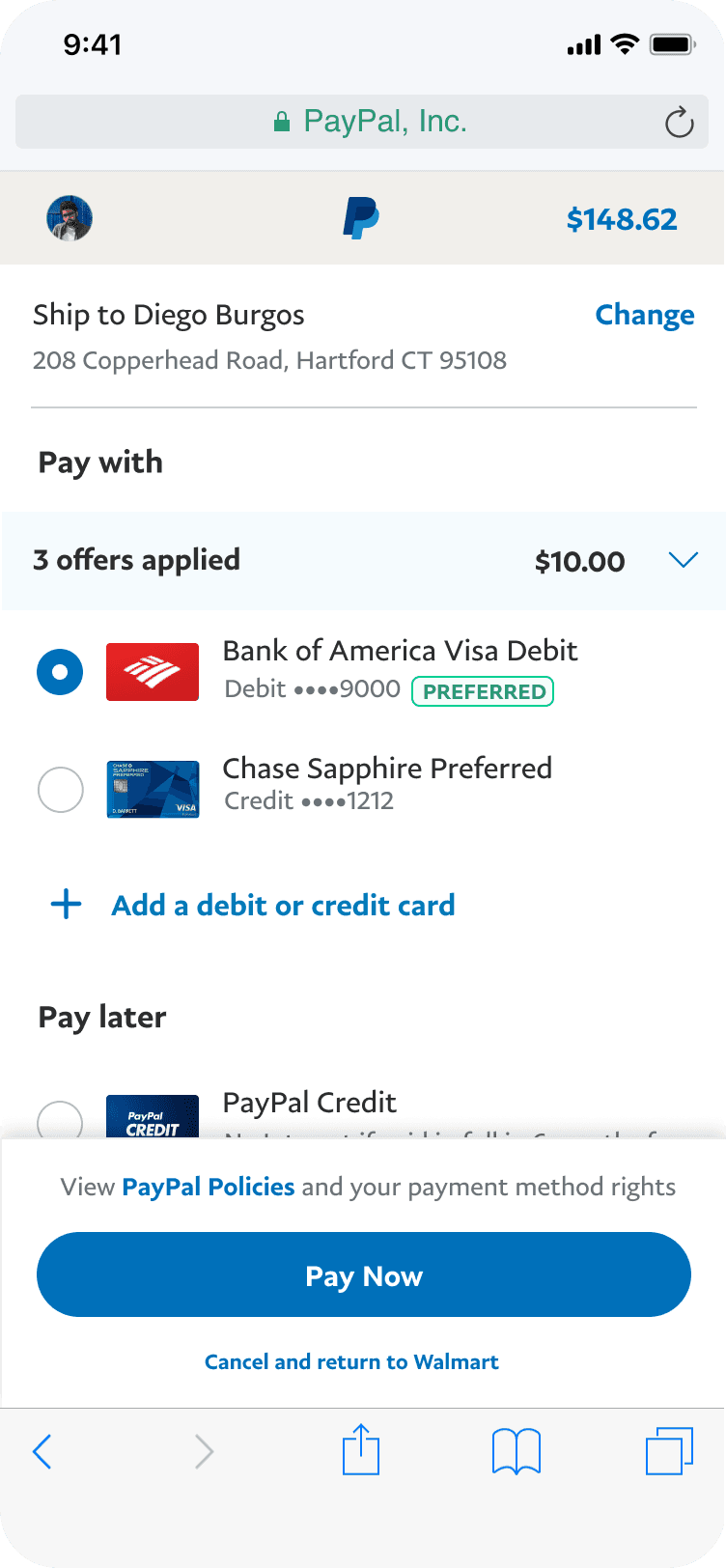

Offers applied

Credit application

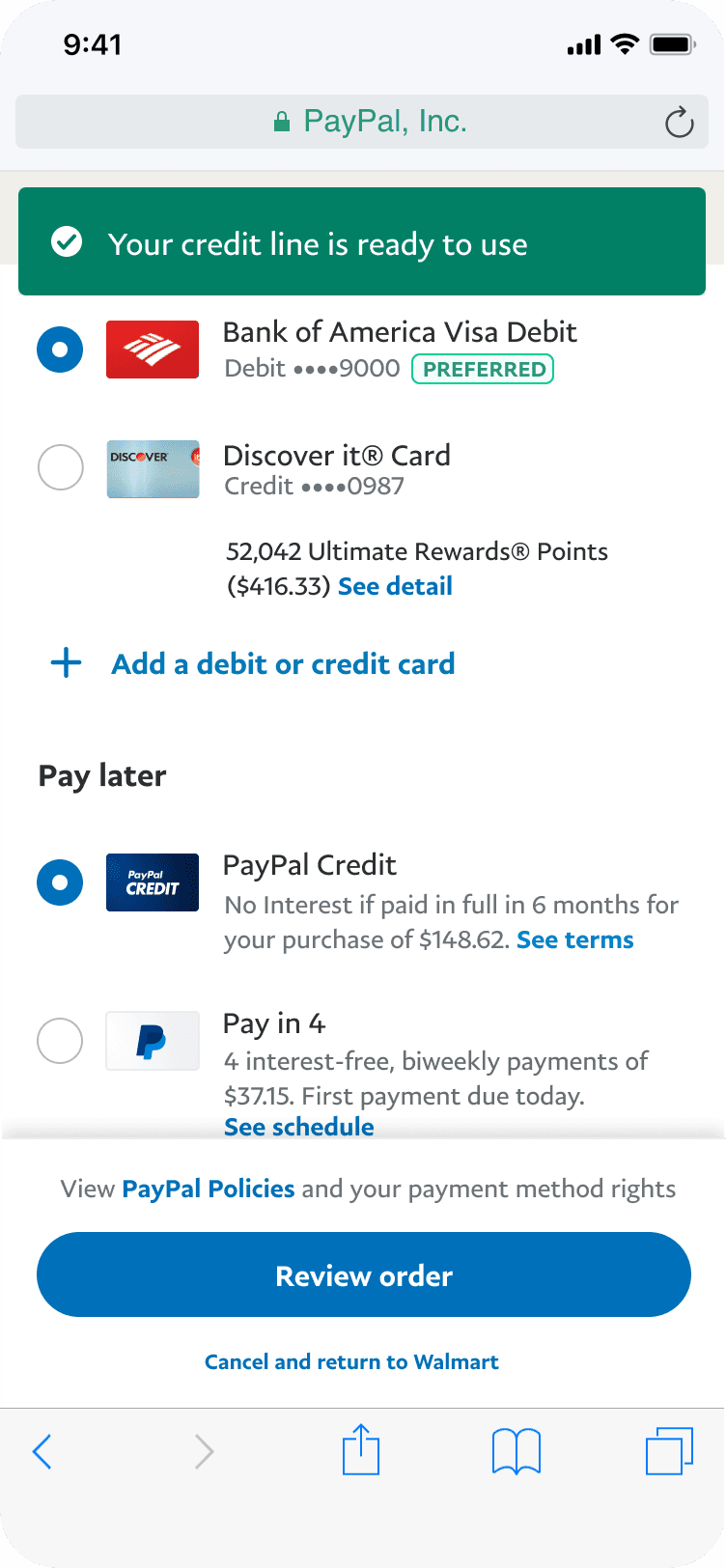

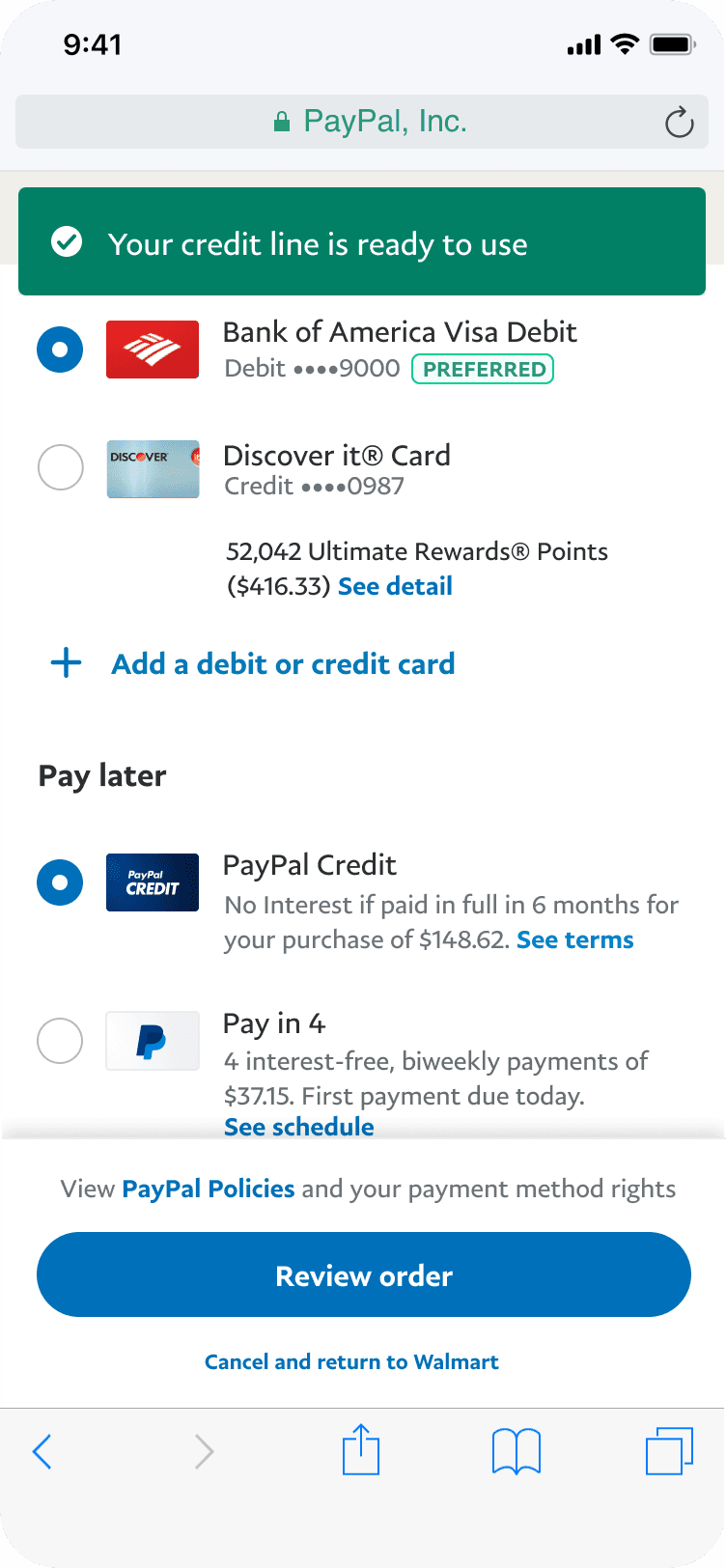

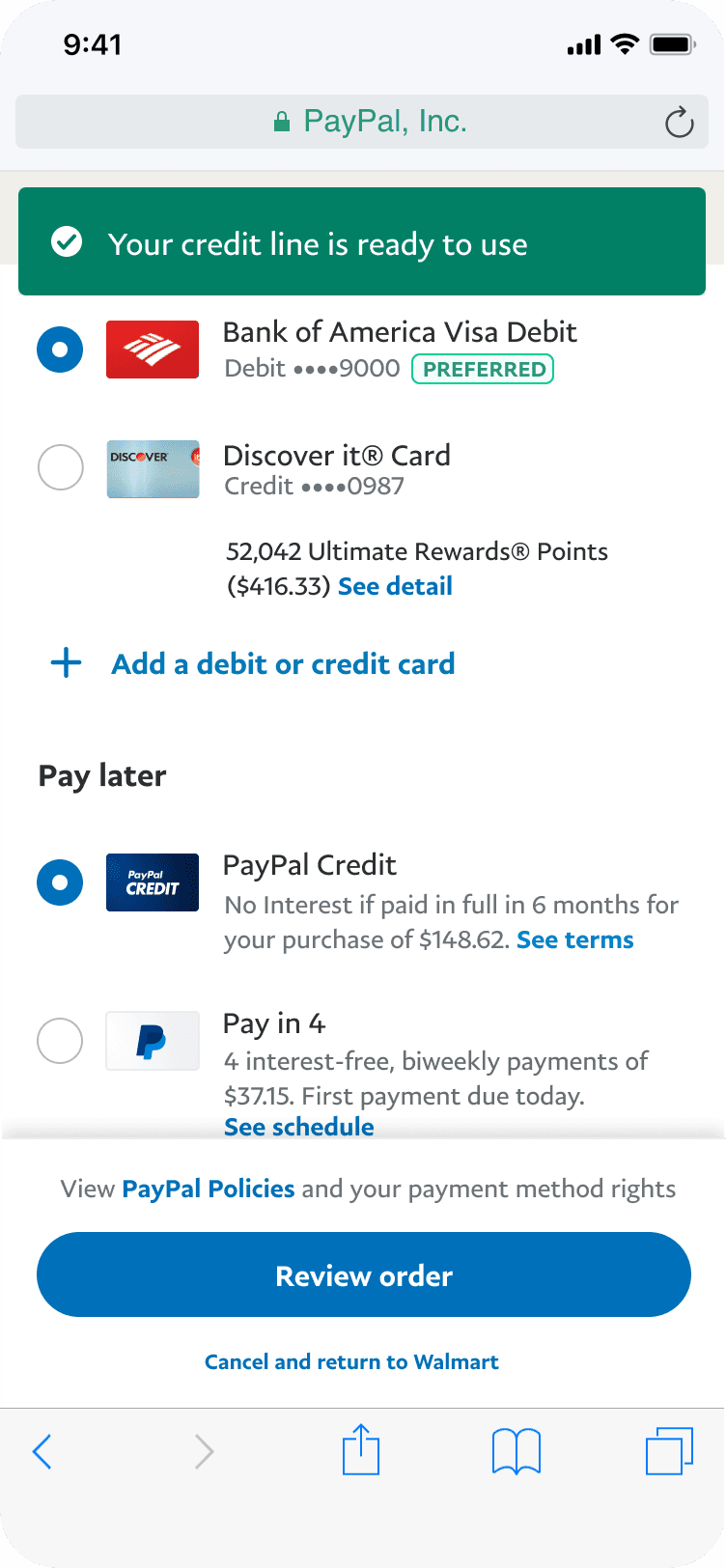

Credit ready to use

Guest checkout

FURTHER EXPANSION

FURTHER EXPANSION

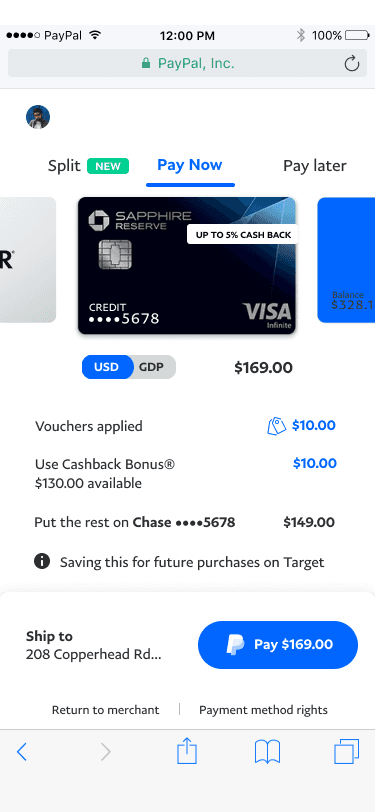

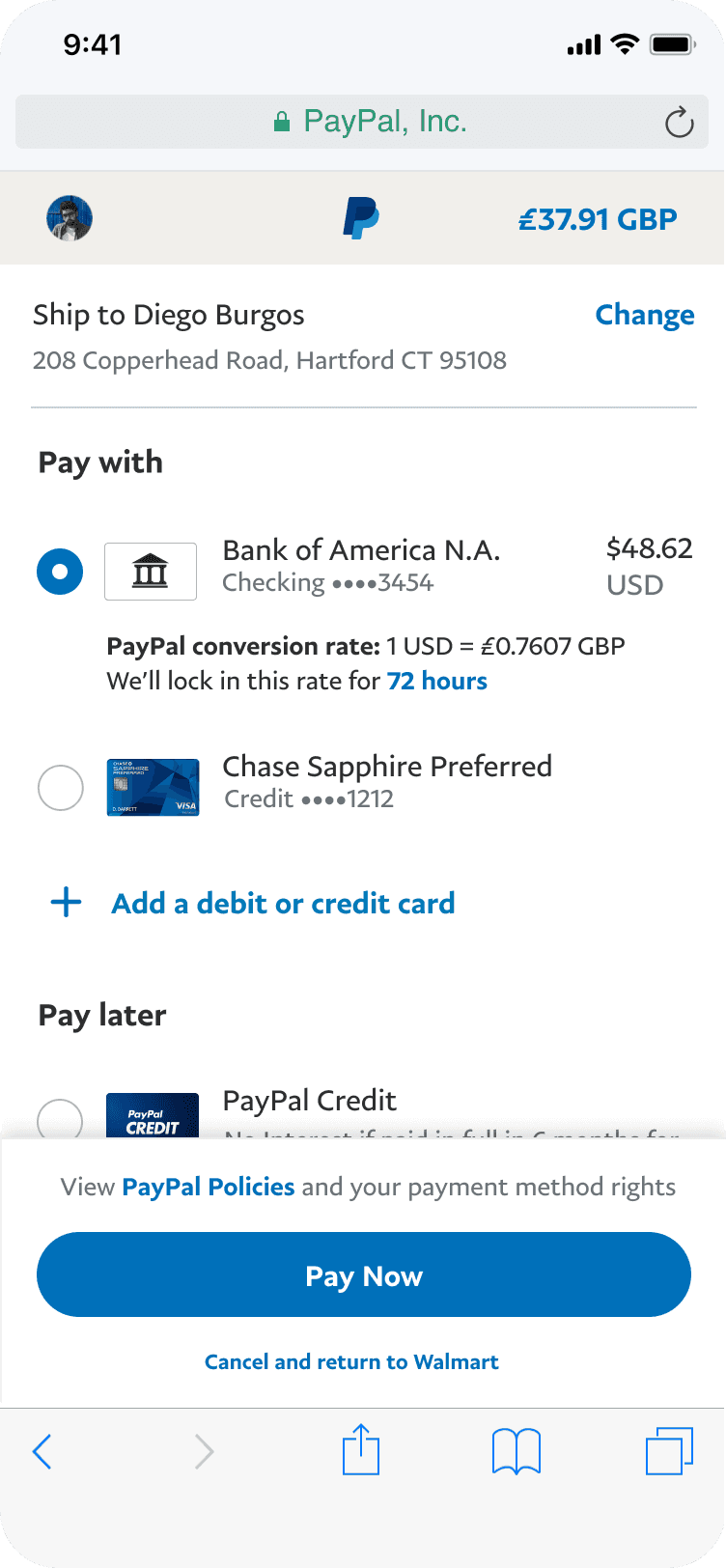

Split payments

Split payments

The redesign facilitated further product expansions for checkout I also designed, like the ability to split payments between different credit cards for a signle transaction.

Today, customers who report using split payments or credit, have 32% higher average spending than those who pay with a single payment method.

The redesign facilitated further product expansions for checkout I also designed, like the ability to split payments between different credit cards for a signle transaction.

Today, customers who report using split payments or credit, have 32% higher average spending than those who pay with a single payment method.